The Grand Duchy’s international approach towards fund management has created a business environment flexible enough to support all structures, designed to facilitate a range of alternative investment strategies, spanning the full liquidity spectrum. The industry also benefits from a wealth of well-established service providers in back and middle office functions, and third party AIFM services, with the ability to tailor solutions to the size and complexity of each asset manager.

Market Growth

The number of private equity funds in Luxembourg with +€1 billion in assets has more than doubled in the past 18 months, with the average size of each fund increasing by 50% since 2018, according to a survey by Alfi and Deloitte. The Grand Duchy now accounts for 15% of European AIF’s, with a 12.4% share of European Alternative AuM.

It is anticipated that one of the major effects of Covid-19 will be the impact on global banking and consequently an increased demand in alternative sources of funding, whether debt or equity.

In 2019 direct lending strategies almost doubled to 32% of the private loan market. It is anticipated that one of the major effects of Covid-19 will be the impact on global banking and consequently an increased demand in alternative sources of funding, whether debt or equity.

Fund Toolbox

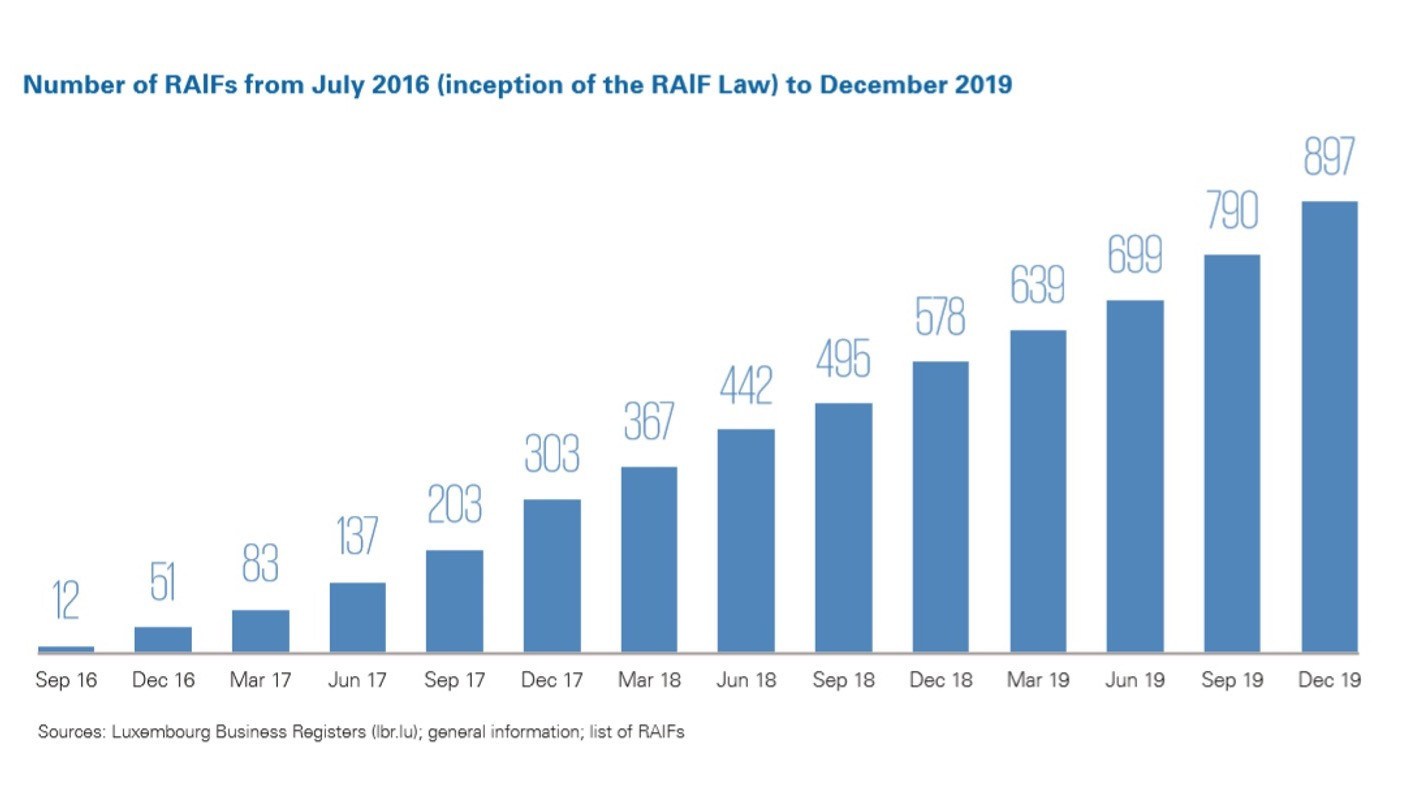

Recent industry reports confirm the excellent acceptance of the Reserved alternative investment fund (RAIF) structure, which was introduced by Luxembourg in 2016 with enhanced time to market being a primary objective. It has turned out to be a clear success, now accounting for four out of every five new funds launched.

The RAIF is a unique multipurpose alternative fund structure, which can be launched quickly as the fund is supervised rather than being fully regulated.

The RAIF is a unique multipurpose alternative fund structure, which can be launched quickly as the fund is supervised rather than being fully regulated. Notably, more than 900 RAIFs have been established since launch and represent more than 51% of all Luxembourg PE.

Number of RAIFs from July 2016 (inception of the RAIF Law) to December 2019 (Grafic: JTC)

Alternative investment fund manager (AIFM)

The role played by the AIFM in supervising and supporting the AIF should not be overlooked. In parallel to the growth in number of AIF’s, Luxembourg now has more than 400 Management Companies, 250 of which are licensed AIFM’s and more than half of those offering third party AIFM solutions.

After the introduction of the AIFMD in 2013, the complexity and cost of complying with financial regulation increased sharply. This is when third party AIFM’s emerged, offering not just to assist with increasingly challenging regulatory compliance, but the complete control of almost all aspects of day-to-day activities of the investment manager, including portfolio management, while also allowing the fund to benefit from its European marketing and distribution passport and avoiding the extensive costs associated with running an AIFM.