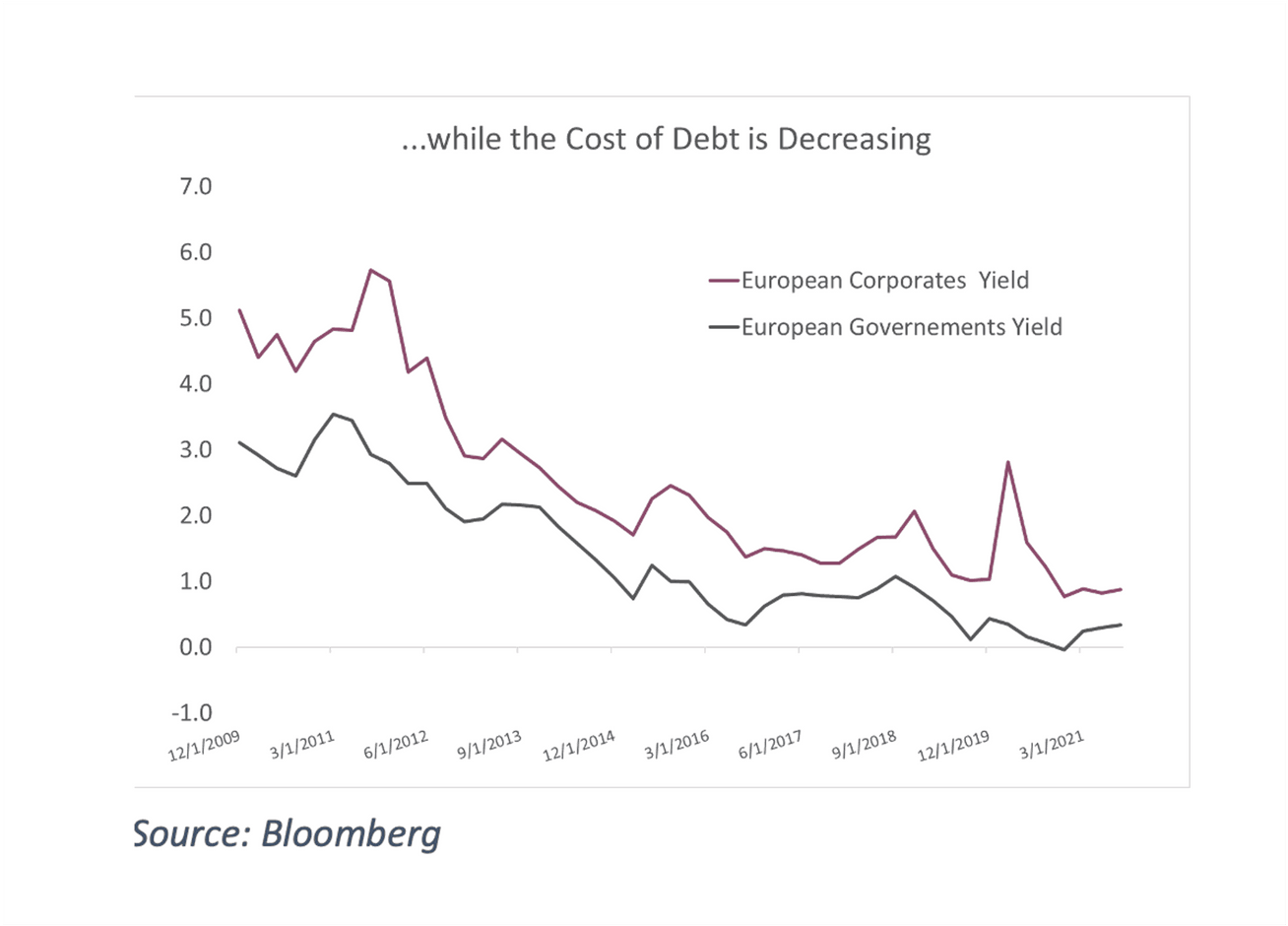

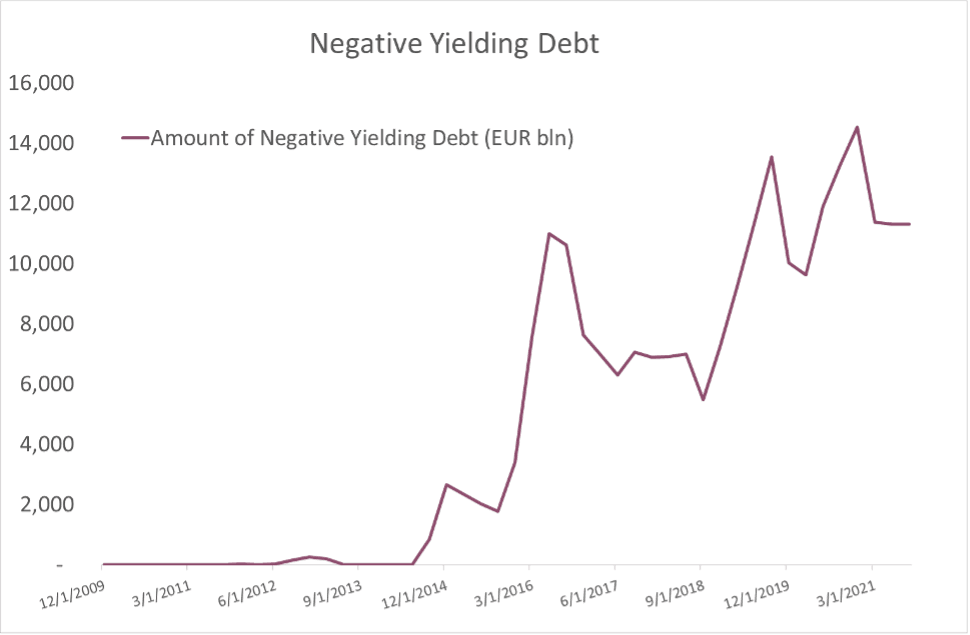

If somebody offered you an investment opportunity that would most certainly lose you money, you would probably laugh. Yet, that is exactly what bond investors have successfully been doing for years. European government bonds made a 4% annualized return over the last ten years, benefiting from continually falling interest rates. Now, investors are facing a double dilemma. Creeping inflation is making their holdings even less attractive, while the risk of interest rates finally rising could penalise them.

Negative Yielding Debt © Bloomberg

Central banks are desperately trying to get the message out that inflation is transitory in nature, but their uneasiness is becoming ever more apparent. Norway’s central bank has delivered the first post-crisis G-10 currency rate hike, and others are bound to act, possibly by tapering their asset purchases.

We can lament the situation and blame it all on the V-shaped recovery and unexpectedly strong demand that has propelled commodity prices and transportation costs and created substantial supply-chain bottlenecks. However, in our view, a demand-driven, strong economic recovery is a good thing. And if the price to pay is more inflation and ultimately higher interest rates, so be it.

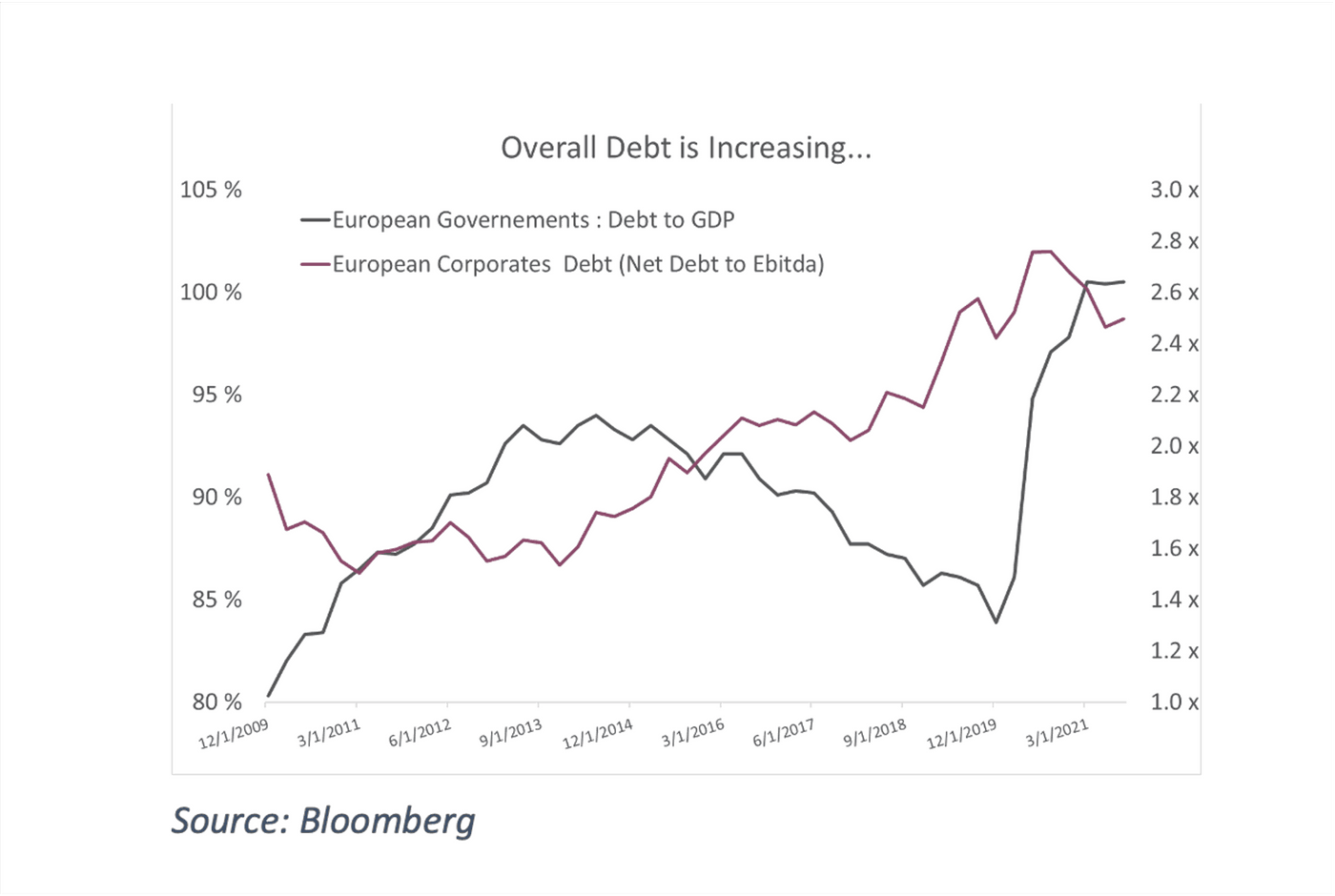

The real question: how far can interest rates go in the years to come? We believe that the scope of any upward rate cycle will be limited. Bear in mind that the overall debt in the system has reached unprecedented levels. Higher corporate leverage has become the new norm, while government debt has skyrocketed during the pandemic. Over-indebtedness coupled with deteriorating demographic trends has consequently depressed the potential overall output growth.

So, what does this mean in terms of investments?

We would argue that carefully selected equities will remain the most interesting investment for years to come. The pace of transformation in many fields is the fastest in human history. It took the automotive industry 62 years to count 50 million drivers, but it took Facebook only four years to get the same number of users. And the impact of this change is more tangible than ever before, whether via climate change, demographics, or technological innovation. 5G deployment, autonomous vehicles, satellite constellations, and Generation Z coming of age are just some examples of megatrends taking shape. At Midas Wealth Management, we continue to invest for our clients in companies with strong balance sheets and structural earnings growth stemming from their relative position to megatrends.

At Midas Wealth Management, we continue to invest for our clients in companies with strong balance sheets and structural earnings growth stemming from their relative position to megatrends.

Naturally, some people consider equities as too volatile and are looking for a more stable income stream. The fact that interest rates are somewhat capped on the upside means that one should not fear and probably not exclude fixed income securities from their portfolio allocation. That said, it is advisable to move away from the traditional government and investment-grade corporate bonds which, due to their leverage and extremely low yields, offer virtually no appeal anymore.

One can still find value in corporate credit as long as it is accompanied by deep fundamental analysis which, at Midas Wealth Management, is managed by Christelle Lenglin and her team. Subordinated financial debt is equally attractive on the back of solid credit metrics. Even some more sophisticated strategies, like long/short credit, still offer attractive returns.

And for investors who are ready to venture further, private debt stands out as another solution that captures higher yields without necessarily deteriorating your risk profile. Indeed, private debt has proven to be quite resilient during the pandemic, offering UHNWI investors an attractive diversification tool. Hence, it is an asset class that responds to investors’ appetite for long-term strategies that can generate returns in a low-rate environment and benefits from favorable macroeconomic conditions.

Private debt has proven to be quite resilient during the pandemic, offering UHNWI investors an attractive diversification tool.

Over the years, we have experienced a surge in private debt deals as financial disintermediation has continued. The European lending scene was dominated by banks for a long time, and this is changing under the weight of regulation. Alternative financing is blossoming. Investors can now benefit from an ever-growing pool of private debt and enjoy a hefty illiquidity premium and low volatility.

At Midas Wealth Management, we have a team of experts led by Benoît Rigollot dedicated to this asset class, with a local presence in Luxembourg. Our fund, dedicated to this asset class, follows a robust investment process based on high selectivity and offers geographic and sector diversification. The specificity of our approach is that we focus on short-term borrowing (generally not exceeding two years) and only on fully collateralized deals. We pay particular attention to the quality of the collateral, the robustness of the structure, and the experience and expertise of the borrower. Our investments benefit from priority of payment and dedicated guarantees like first-rank mortgages or lenders’ notarized surety. The fund has been an income generator and a real shock absorber during the health crisis.

Despite challenging market conditions, there are still exciting investment opportunities out there. As inflation roars back into our lives, it is important to identify them and put money to work.