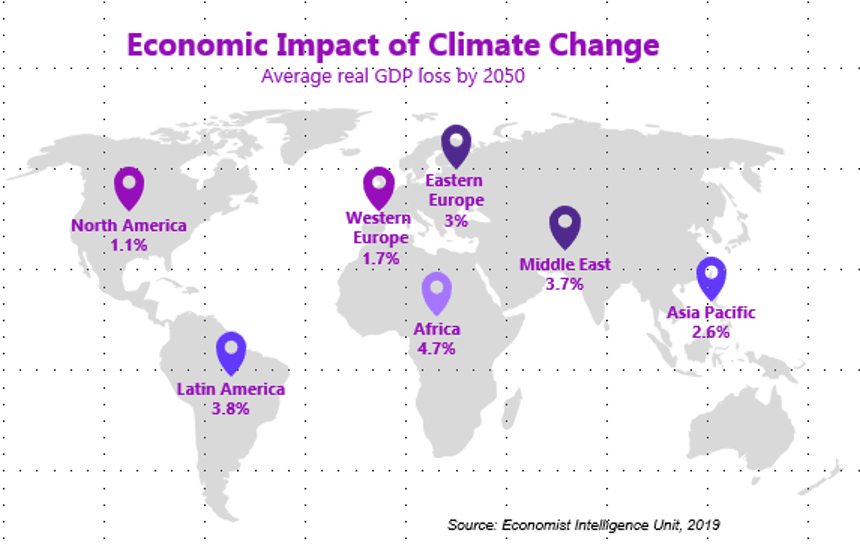

Economic Impact of Climate Change. (Credit: Economist Intelligence Unit, 2019)

Climate-related financial risks are typically classified in two categories: transition risks and physical risks. Transition risks arise from transition to low carbon economy, changes in policy, technology affecting the value of assets and liabilities for banks and insurers. Physical risks arise from acute and chronic shifts in climate patterns, which can lead to damages of assets, business disruption and financial losses.

In August 2019, a tornado caused severe damages to some areas of Luxembourg. The estimated damage lies at €100 million mark.

Under these circumstances, it is not surprising that the identification and measurement of the climate-related financial risks as well as their integration in the prudential framework have moved up the regulatory agenda of the Supervisory Authorities.

The Basel Committee steps into the game

In early 2020, the Basel Committee on Banking Supervision (BCBS) set up a high-level Task Force on Climate-related Financial Risks (TFCR) with the mandate of enhancing global financial stability through analysing existing regulatory and supervisory initiatives on climate-related financial risks and developing the supervisory practices to mitigate these risks.

As part of the mandate, the BCBS has released two reports on climate-related financial risks discussing (1) the transmission channels of the climate-related risks to the banking system and (2) the measurement methodologies and challenges of climate-related financial risks.

Main challenges related to the measurement of climate-related risks

The BCBS report highlights the challenges and the need for more granular data and methodologies caused by the unique features of climate-related risks.

The measurement of the climate-related risks involves various sources of uncertainty that can lead to the misestimation of risks. These uncertainties include assumptions regarding the precise nature, timing, frequency, severity and geolocation of the climate change impacts. At the same time, these uncertainties depend on social and demographic factors, such as values, behavior of market actors, technology and policies, which are deeply uncertain.

Although conventional risk measurement approaches can be adapted to assess climate risks, the BCBS states that “in practice, […] the range of impact uncertainties, time horizon inconsistencies, and limitations in the availability of historical data on the relationship of climate to traditional financial risks, in addition to a limited ability of the past to act as a guide for future developments, render climate risk measurement complex and its outputs less reliable as risk estimators”.

Data is the key

Considering the presence of uncertainties, the measurement of the climate-related risks will require new, more granular and unique data. The data needed to translate these risks in financial exposure may not be fully available for banks. Moreover, being part of the prudential risk framework, climate-related data will need to comply with the current regulatory data quality expectations (BCBS 239), which may impose additional challenges, as the climate-related data is usually non-standardized and uses various data definitions and taxonomies.

The time has arrived to understand and collect climate-related data using internal and external resources. A clear governance and architecture with quality controls must be installed to ensure validity, appropriateness, traceability and harmonization of the data collection and preparation process.

More information about Avantage Reply Luxembourg .