In January 2021, Luxembourg’s Minister of the Environment, Climate and Sustainable Development, Carole Dieschbourg, presented the third national plan for sustainable development, which has been established by the Luxembourg government on the basis of the seventeen Sustainable Development Goals (“SDGs”) of the United Nations (“UN”) 2030 Agenda for Sustainable Development. The plan is Luxembourg’s main instrument for implementing the SDGs and includes ten priorities which will serve as the government’s roadmap to contribute to the achievement of the objectives of the UN’s Agenda 2030.

By 2030, Luxembourg targets a 25% share of renewable energy and a 40% to 44% reduction in final energy consumption.

One of these priorities relates to protecting the climate, adapting to climate change and providing sustainable energy, and sets ambitious objectives in terms of climate policy: zero net emissions by 2050 and a 55% reduction of greenhouse gas emissions by 2030 compared to 2005. Moreover, by 2030, Luxembourg targets a 25% share of renewable energy and a 40% to 44% reduction in final energy consumption. These objectives even exceed the binding climate and energy targets for 2030 which have been set at EU level to contribute to reaching the objectives of the 2015 Paris Agreement on Climate Change: reduce greenhouse gas emissions by at least 40% (from 1990 levels), increase energy efficiency by at least 32.5% and increase the share of renewable energy to at least 32% of EU energy use.

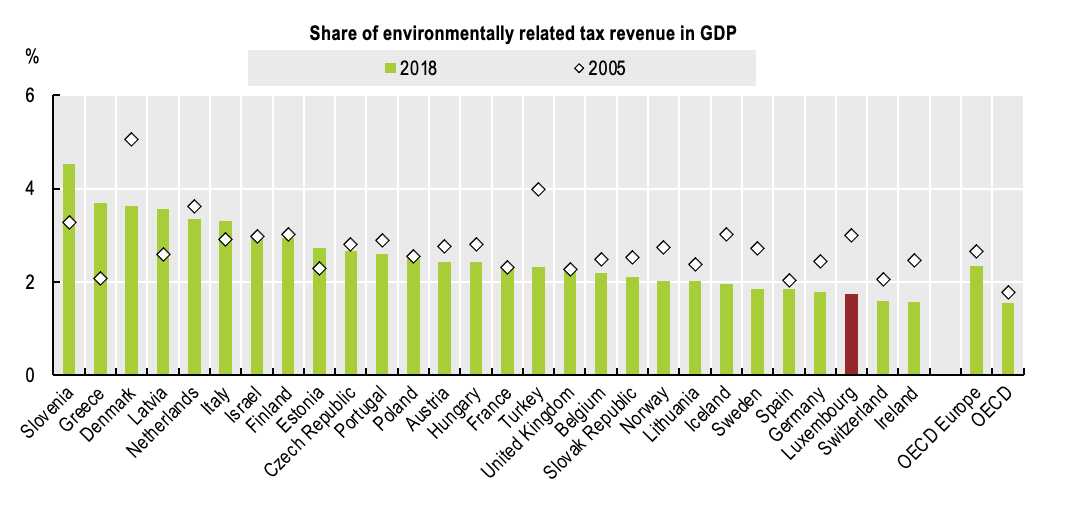

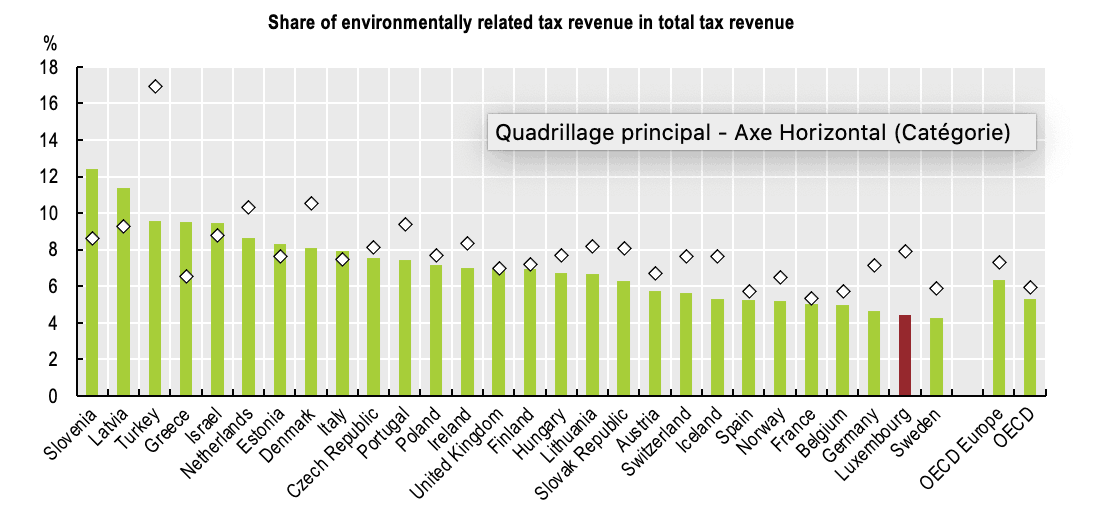

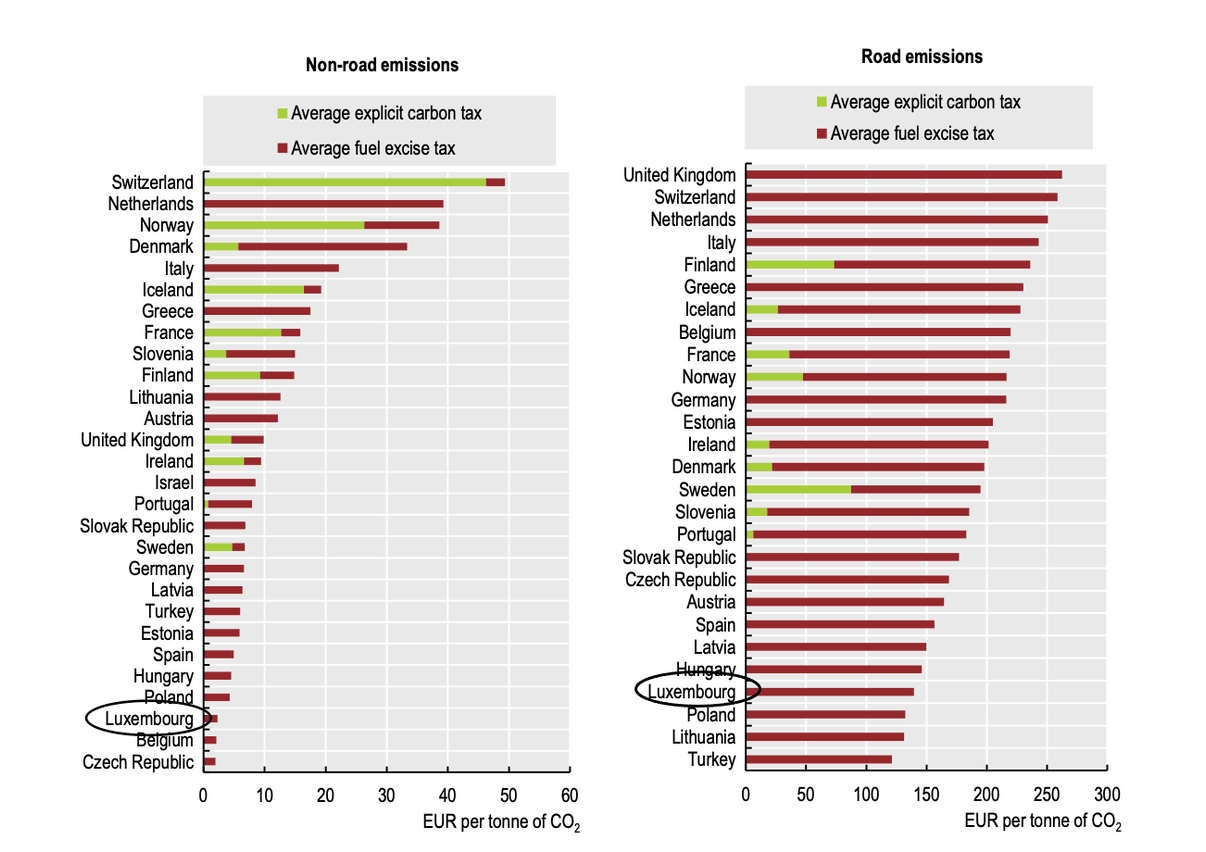

In order to ensure that the EU targets are met, EU legislation requires that each Member State prepares a ten-year National Energy and Climate Plan (“NECP”), setting out how to reach its national targets. Luxembourg’s NECP includes, amongst others, measures related to decarbonisation. An instrument in this respect are environmental taxes. According to the 2020 OECD Environmental Performance Review for Luxembourg, the share of environmental tax revenue compared to the total tax revenue in Luxembourg is well below the average of the OECD Member States, but also below the average of the OECD European countries. It represented 4.5% of Luxembourg’s total tax revenue in 2018 (vs 6.3% of tax revenue in 2018 in the OECD European countries) and only amounted to 1.8% of the GDP in 2018 (vs an average of 2.3% for OECD European countries). Notably the excise taxes and hence the prices of fuel are low compared to its neighbouring countries. According to the NECP, Luxembourg will only be able to meet its climate objectives if it progressively reduces this price gap, and hence its fuel exports (related CO2 emissions being accounted for in the country selling the fuel).

Share of environmentally related tax revenue in GDP OECD (2019), "Environmentally related tax revenue", OECD Environment Statistics (database).

Share of environmentally related tax revenue in total tax revenue OECD (2019), "Environmentally related tax revenue", OECD Environment Statistics (database).

Note: 2018 tax rates as applicable on 1 July 2018, and hence not including the carbon tax introduced in 2021, nor the increase of excise taxes on petrol and diesel introduced in 2019 OECD (2019), Taxing Energy Use 2019: Using Taxes for Climate Action.

With the introduction of the carbon tax as from 2021, Luxembourg has taken a step towards the increase of environmental taxes. According to the announcement in the budget law for 2021, the main objective of the carbon tax is to reduce the consumption of fossil energy, making it a key element for Luxembourg to reach its climate objectives. The additional tax revenues will be used to finance, amongst others, the subsidies for the energy renovation of residential buildings (which are part of the PRIMe house program), and for electric cars, as well as public investments into the development of renewable energy or the extension of the public transport infrastructure. The tax will be progressively increased from EUR 20/tonne of CO2 in 2021 to EUR 30/tonne of CO2 by 2023. In an international context, this level of carbon tax is still on the lower end of the spectrum, but is expected to be further increased after 2023. As a comparison, Sweden introduced a carbon tax as early as in 1991 and has progressively increased this tax up to EUR 114/tonne of CO2. According to an analysis performed by the STATEC, the Luxembourg carbon tax on its own will not be sufficient to reach the targeted -55% in greenhouse gas emissions by 2030.

In addition to the carbon tax, the NECP also announced a review of the motor vehicle tax based on the polluter pays principle.

Environmental taxes can be part of the solution to reduce CO 2 emissions, by promoting energy saving and the use of renewable resources and by providing revenues for public investments into climate change mitigation.

Environmental taxes can be part of the solution to reduce CO2 emissions, by promoting energy saving and the use of renewable resources and by providing revenues for public investments into climate change mitigation. However, to allow Luxembourg to reach its ambitious objective in terms of reduction of CO2 emissions, other measures included in the NECP such as public investments and subsidies, research and development, are equally important.

In September 2020, the Commission proposed to raise the greenhouse gas emission reduction target to at least 55% compared to 1990 and is expected to come forward with a proposal for updated legislation by July 2021.

Plan national intégré en matière d’énergie et de climat du Luxembourg pour la période 2021-2030 (PNEC).

OECD (2020), OECD Environmental Performance Reviews : Luxembourg 2020, OECD Environmental Performance Reviews, OECD Publishing, Paris, page 94 https://doi.org/10.1787/fd9f43e6-en.

Ibidem

Projet de loi N°7666 concernant le budget des recettes et des dépenses de l’État pour l’exercice 2021, rapport de la Commission des Finances et du Budget.

STATEC, Novembre 2020, Évaluation de l’impact de la taxe CO2.