In recent years, with the legislative developments on environmental, social and governance (ESG), the market and investors have called for asset managers to take on a more active role in promoting the ESG through funds under their management. Under such background, although ESG-linked carried interest is not yet a common practice in the market, it is starting to gain traction as more investors demand greater accountability and transparency from the asset managers on how they integrate ESG factors into their investment decisions and operations.

There is no one-size-fits-all formula for calculating ESG-linked carried interest, as different funds may have different structures, terms and conditions.

So, what is ESG-linked carried interest?

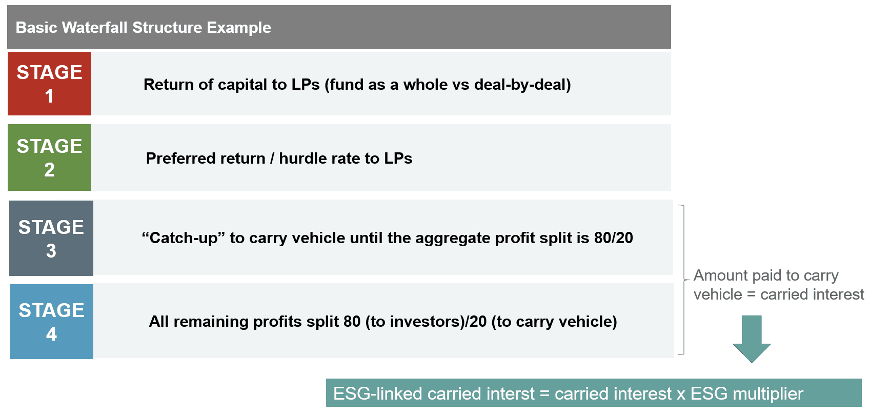

ESG-linked carried interest is still largely a performance-based compensation, but it enables the asset managers to align their interests with society by incorporating ESG criteria into the calculation of the carried interest (i.e. through ESG adjustment to the carried interest). The aim is to incentivise the asset managers to integrate ESG factors into their investment strategies and decisions, and to reward them for achieving positive ESG outcomes.

There is no one-size-fits-all formula for calculating ESG-linked carried interest, as different funds may have different structures, terms and conditions. However, a common approach is to adjust the carried interest rate based on the achievement of predefined ESG targets or benchmarks, either increasing or decreasing it depending on the ESG performance of a fund’s investments.

What to expect on ESG-linked carried interest? Maison Moderne

How to calculate ESG-linked carried interest?

The calculation of ESG-linked carried interest can vary depending on the specific terms and conditions agreed between the investors and the asset managers, but generally it involves the following steps:

- Determine the ESG targets, benchmarks and metrics (such as carbon emissions) in order to measure the ESG performance of a fund’s investments. These should be aligned with the fund’s investment strategy, the industry standards, and the international frameworks, such as the UN Sustainable Development Goals, the Principles for Responsible Investment, or the Task Force on Climate-Related Financial Disclosures.

- Set the level of ESG achievement and the corresponding ESG multiple that increases or decreases the carried interest. For example, the carried interest rate can be (i) increased by a certain percentage if the investments reduce their carbon emission by a certain amount, or (ii) decreased by a certain percentage if they fail to meet a minimum threshold.

- Establish the ESG reporting and appraisal mechanisms that will ensure the reliability and accuracy of the ESG data and the calculation of the ESG-linked carried interest. These can include internal or external audits, third-party certifications or independent ratings.

- Apply the ESG adjustment formula to the actual ESG performance of the investments (usually at the end of the investment period or at the disposal of such investments). The formula should specify (i) how the ESG multiple is weighted and aggregated across the portfolios, (ii) how the weighted ESG multiple is applied to the carried interest calculation, and (iii) where to allocate the reduced carried interest (e.g. some funds will use the reduced carried interest to purchase carbon credits).

ESG-linked carried interest, being a novel and innovative way to incentivise the realisation of the ESG objectives, also poses some challenges and complexities in terms of design, implementation and governance.

In practice, when designing the ESG-linked carried interest mechanic, the investors and the asset managers often focus on the following key negotiation points:

- The level of ambition and realism of the ESG targets or benchmarks, as well as the balance between rewarding positive ESG outcomes and penalising negative ESG impacts.

- The transparency and independence of the ESG reporting and appraisal mechanisms, including for example the frequency and format of the ESG reporting and appraisal, and the dispute resolution mechanic when the parties cannot agree on the ESG appraisal results.

- The simplicity and clarity of the ESG-linked carried interest formula that can also bring a fair balance of the ESG performance with the financial performance of the investments.

ESG-linked carried interest, being a novel and innovative way to incentivise the realisation of the ESG objectives, also poses some challenges and complexities in terms of design, implementation and governance. Therefore, it requires a clear and transparent communication and collaboration between the investors and the asset managers, together with a robust, fair and flexible framework for setting, measuring and rewarding the ESG performance.