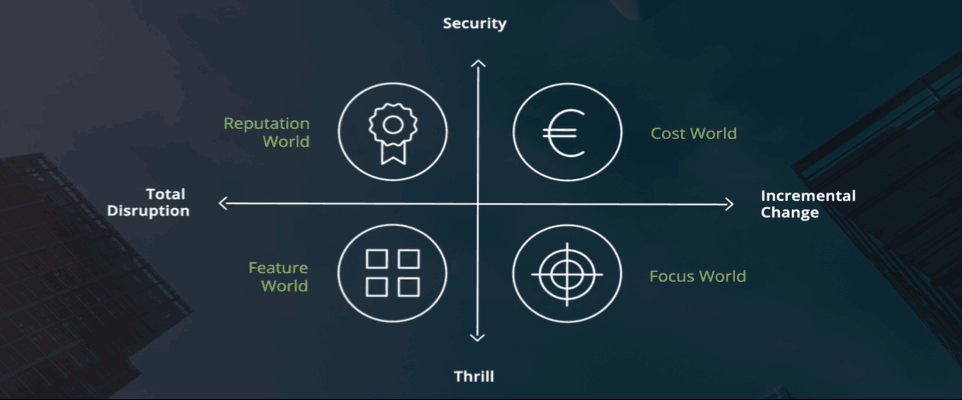

Scenario 1: Cost World

In this scenario, banks are operating in a stable environment. The client’s needs are predictable as HNWIs value trust, security, and wealth preservation. The reputation of private banks and independent wealth managers is therefore a decisive factor for HNWIs. There remains limited appetite amongst clients for innovative solutions, and therefore established services have become commodities. This puts significant pressure on costs, with economies of scale being key for a bank’s survival. In turn this drives consolidation in wealth management and private banking, an industry that consists of a few big players, as well as some niche ones.

Scenario 2: Focus World

Here, HNWIs are drawn to innovative wealth management offerings at the expense of traditional solutions. Client demands are volatile and driven by a desire for immediate consumption. As a result, HNWIs select their service providers in line with their needs and build their own customized eco-systems consisting of incumbent banks, financial intermediaries, FinTechs, and BigTechs. Innovative players are able to generate high margins on value-added and unconventional solutions that put traditional banks under pressure. In this world, the danger is that banks will be left with highly regulated and unprofitable services only.

Scenario 3: Feature World

This is a ‘big-bang’ world in which HNWIs become increasingly attracted to emerging offerings, while the operating models of banks undergo disruption because of new technologies (e.g. decentralized ledgers, full automation, tokenization of non-bankable assets). As a result, banks are under attack at the front-end by alternative providers (FinTechs, BigTechs, intermediaries, etc.) and simultaneously disrupted at the back-end by emerging technologies from new providers. As providers are increasingly offer customized features, the competition around pricing for standard products has intensified and drives fragmentation of the wealth management market. It is critical that there is an open banking environment, built on strong, innovative capabilities, which allow clients to assemble banking services according to their needs.

Scenario 4: Reputation World

In this scenario, security is key for clients as the bank’s back-end operating models become fully disrupted. HNWIs prefer to have their assets managed by regulated and stable institutions such as banks. Holdings are not restricted to traditionally traded assets but include tokenized assets such as art. The reputation that a wealth manager has built with their clients allows them to act as quality assurers for these innovative offerings. In the back-end, the majority of processing is outsourced to global providers of cloud solutions, leaving banks less vulnerable to cost pressures from technologically more advanced providers.

Each of these scenarios are different. Each represents its own challenges. Are you excited for the next frontier?