Investing strategies focused on environmental, social and governance factors, better known as ESG strategies, often employ screening, exclusions, and integration among other tactics. But at their core, all these strategies are about investing in ‘sustainable’ businesses.

This may sound simplistic, but achieving a long-term future for any business hinges on sustainability pervading all aspects of the company. To be clear: a company that ignores its environmental externalities is unable to retain talent, or that is not compliant with regulations won’t be able to sustain its operations into the future. Conversely, as numerous studies have shown, companies with higher sustainability characteristics deliver superior value over the longer term.

Avoiding value destruction through a ‘sustainability’ lens

A recent example is China’s peer-to-peer (P2P) lending industry, which saw rapid growth until a few years ago. By June 2018, estimated P2P outstanding loans topped 1 trillion renminbi ($155 billion). Before regulators stepped in, companies such as Yirendai, Paipaidai and Qudian were charging effective interest rates as high as 35 to 40 per cent. In the years since, regulatory intervention has helped lead to a dismantling of the P2P lending industry in China.

Investors looking at the sector’s rapid rise through a sustainability lens might have been better able to sidestep some of the value destruction that ultimately ensued. Interest rates charged by some of these companies were clearly excessive and unsustainable.

Examples abound globally. The story of Martin Shkreli’s Turing Pharma is another case of an unsustainable business model, whereby the firm, in its bid to boost profits, put through massive price increases for life-saving medicines that then became unaffordable for most patients. Value destruction can also come from companies that have run businesses with unsustainable debt structures such as General Electric, which in recent times was forced to undertake significant asset sales to pare down debt.

Valuation implications

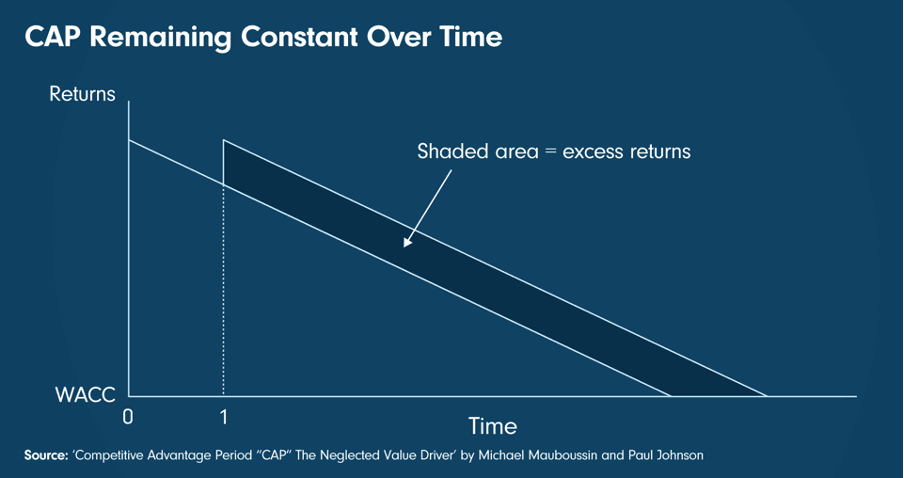

The principle of sustainability is linked to the concept of Competitive Advantage Period (CAP) developed by Miller & Modigliani in 1961, which was expanded upon by Michael Mauboussin and Paul Johnson in 1997. Essentially, the longer a company can expand its CAP, the more value it will create.

We can expand this concept further by calling it Sustainable Competitive Advantage Period (SCAP). This is a period during which, by virtue of its ESG and stakeholder-centric business practices, a company can reduce the risks to longevity of its CAP and prolong this period thereby driving value.

Sustainable Competitive Advantage Period (SCAP)

All valuation methodologies, whether they are the traditional ones of price to earnings and price to book, or the recently popular ones like price to sales or enterprise value to sales, are essentially shortcuts to understanding the present value of future cash flows, which investors also calculate via a discounted cash flow (DCF) analysis.

This is what makes sustainability important and a big factor in long-term value creation. It can help close the gap between expectations and outcomes, while protecting an investment from a permanent loss of capital.

What are the red flags investors can look out for?

Some red flags that investors should look out for include excessive returns, complex business structures, lack of regulatory clarity, short-term focused management incentive structures, low or no focus on a stakeholder analysis, and reliance on debt to enhance returns.

While this list is not comprehensive, viewing any business through a sustainability lens will go a long way in helping investors allocate capital to companies that will drive long-term value creation and mitigate exposure to permanent loss of capital. In the case of the Chinese P2P industry mentioned earlier, excessive returns of the lenders, complex fee structures and lack of regulatory clarity were all red flags.

Sustainability should be a key part of any investment analysis

Sustainability of a business is a key input in estimating its potential for value creation. While analysts tend to focus on estimating the competitive advantage period, true sustainability comes when a business takes it farther, with a focus on relevant ESG aspects and by adopting a stakeholder-centric approach. A comprehensive evaluation of sustainability should be a key part of any investment analysis.

Read out more: