The road to mainstream

Sustainability in business has evolved over the last decade from a niche activist topic to being on the minds of every investor and executive. In 2011, only 20% of S&P 500 companies published corporate sustainability reports, which were largely marketing exercises with no specific targets or actions. Fast forward to 2022, sustainability has become the mainstream business issue and disruption topic dominating the headlines – with BlackRock, one of the largest asset management firms in the world, founder Larry Fink recently telling his CEOs:

“There is no company whose business model won’t be profoundly affected by the transition to a net zero economy… companies not quickly preparing themselves will see their businesses and valuations suffer…”

Today, driven by government intervention, changing expectations, lightning-speed growth in green tech and far-reaching megatrends, sustainability is a driving force for transformation – and companies are taking notice. Now, more than 9 out of 10 S&P 500 companies provide sustainability reports, two thirds have set emission reduction targets with roughly one third setting science-based targets with a roadmap of precise emission reduction targets in line with the Paris Agreement.

Fast forward to 2022, sustainability has become the mainstream business issue and disruption topic dominating the headlines.

Sustainability is similar to digital, except not optional

At its core, sustainability in the context of business is about creating value for shareholders while having a positive impact on the environment and society. ESG on the other hand, first coined in a UN report in 2004, refers to environment, social, and governance. It is a quantitative framework used to evaluate a company’s long-term performance of sustainability and views it as a proxy for long-term value creation. It’s this broad scope of ESG that makes it challenging for companies to wrestle with.

ESG (Illustration: PwC)

Similarly to digital, ESG impacts all aspects of a business because it fundamentally redefines how companies do business from strategy to measuring performance to reporting financial results. And this transformation will be primarily enabled through emerging technology and data that will – similarly to digital – rewrite business models and blur boundaries between industries to generate new waves of growth. Unlike digital, however, it isn’t optional. Government intervention is rapidly accelerating, with Europe having already taken a strong stance to become the first climate-neutral continent with roll-outs of the EU Green Deal, Fit-for-55 package, taxonomy, Corporate Sustainability Reporting Directive (CSRD), just to name a few. And the United States and the SEC are following suit. Yet experts say that the current progress is not sufficient to limit the temperature increase to well below 2°C above pre-industrial levels and so we should expect government intervention to rapidly accelerate – further increasing the pressure on business to transform and be disrupted by sustainability.

All industries are impacted – but technology will accelerate some more rapidly than others

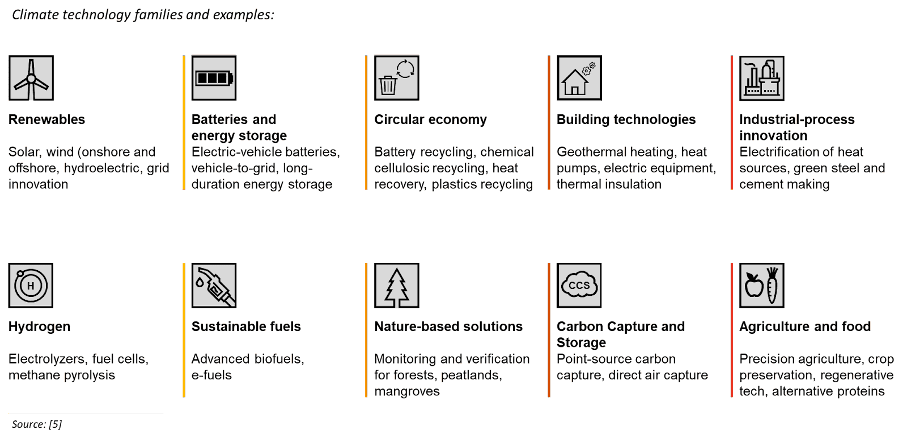

No industry is safe from ESG. But there are clearly those that are more exposed to disruption than others. The resilience of these businesses will be driven by their ability to harness and implement both emerging technology and data solutions. Emerging technologies, like the ‘families’ below, will drive the industry’s transition to net zero by providing alternatives to carbon-heavy activities, energy consumption and/or the usage of finite resources.

Climate technology families and examples (Illustration: PwC)

Data solutions, on the other hand, will enable companies to not only baseline their current greenhouse gas footprint and activities, but also develop future required investor-grade nonfinancial SOX style reporting as regulators enforce auditing of non-financial reports – as recently announced for the CSRD directive. Like for digital, technology and data will be the key enablers of the ESG transformation – providing both a pathway to transition and the ability to monitor and report.

The automotive industry – a tale of disruption and caution

Few industries have experienced a more dramatic shift due to ESG than the automotive industry. Within two years, the industry has been turned upside down, from initially fighting emission standards to now targeting electric only vehicles by 2035 – driven by the recently voted directive of the European Parliament. An unthinkable feat five years ago.

“The New Equation” – PwC’s commitment to helping our clients build trust and deliver sustained outcomes

Acting on our convictions – last year we made our own net zero SBTi commitments for 2030 and launched our new global strategy called “The New Equation.” A US $12 billion investment program over five years encompassing 100,000 net new jobs, “The New Equation” is our global new strategy focusing on helping our clients understand and navigate the challenges of climate change and the broader ESG agenda. We tackle the breadth of the ESG agenda with our multidisciplinary team of passionate diverse problem solvers across our audit, tax, and advisory services. This multidisciplinary model ensures support across our clients’ four-phase ESG transformation – from understanding the unique ESG ecosystem, to developing an ESG strategy with actionable roadmap, launching an ESG transformation and reporting with investor-grade non-financial disclosure capabilities.

“The New Equation” is our global new strategy focusing on helping our clients understand and navigate the challenges of climate change and the broader ESG agenda.

In summary, sustainability is disrupting how organisations do business today and will be the major factor in deciding the winners and losers of tomorrow’s global economy. Companies that launch a successful sustainability transformation journey focusing on long-term value creation across E, S and G are well poised to build a competitive advantage, expand shareholder value and build a better future.

Citations:

[1]

[2]

[3] https://content.ftserussell.com/research/niche-norm

[4]

[5]https://www.mckinsey.com/business-functions/sustainability/our-insights/delivering-the-climate-technologies-needed-for-net-zero

[6]

[7]

[8]