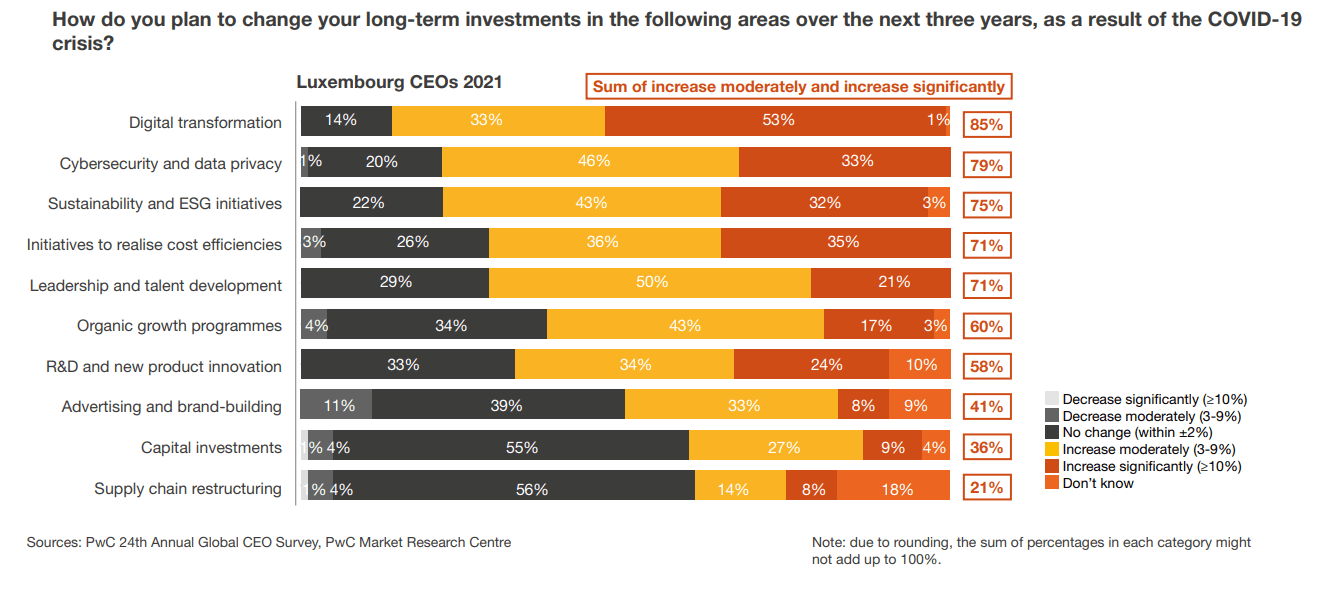

Governments turned to digital to trace risky contacts, grocers turned to e-commerce to serve their clients, teachers became YouTubers, and banks have learned to work remotely and serve their clients in a very different way. As our recent and surveys confirm, digital transformation will be continuously progressing on the banks’ agenda and, more globally, in the financial sector. More than 80% of CEO respondents in the financial sector will be increasing their investment in the domain.

These changes also introduce new threats and challenges. Among them, we see a steep increase of cyber risk concerns, to a record high of 79% in the banking and financial sector. A key question remains: how to make those initiatives successful in a challenging environment?

How are digital technologies transforming banking and helping to face the challenges?

In this low-interest and home-based working period, the financial industry has to both ensure the continuity of its services towards its clients, while also providing the appropriate environment for employees and providers in order to continue to operate in a contactless world.

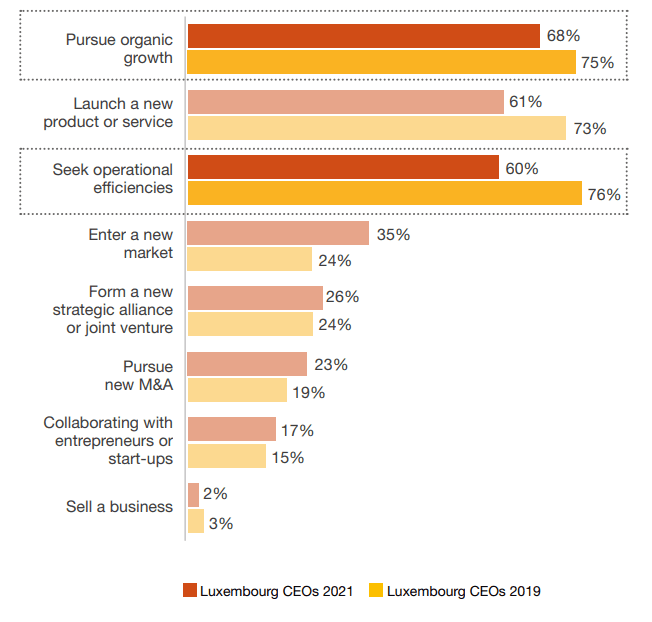

Leveraging the lessons of the first year of the pandemic, many actors are reconsidering their working habits and practices to ensure their sustainability, both operationally and financially. As our CEO survey reveals, operational efficiencies will remain a strong driver of the upcoming investments in the financial sector. More than 60% of surveyed CEOs will make it a priority. It’s seen as a prerequisite to drive growth and to be able to launch new products and services. Two thirds of financial institutions will be looking into this.

As our CEO survey reveals, operational efficiencies will remain a strong driver of the upcoming investments in the financial sector.

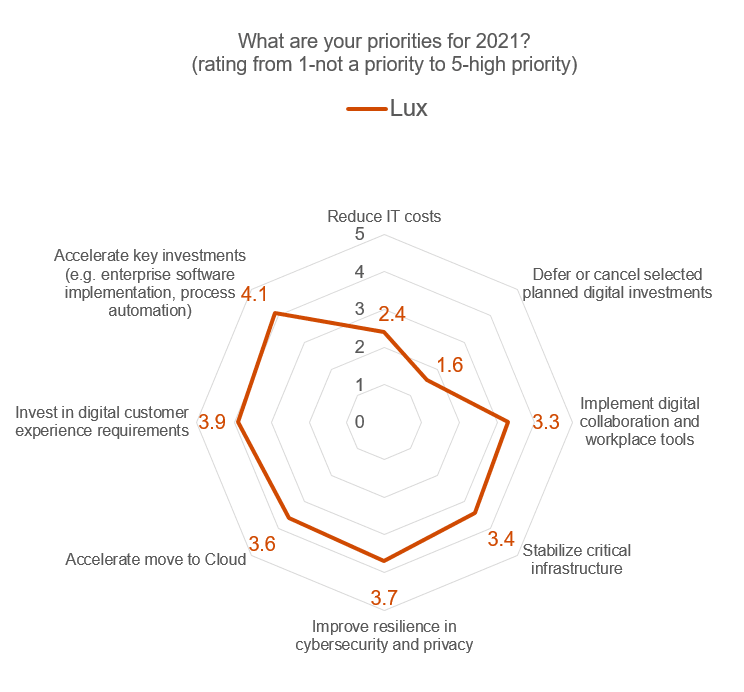

COVID-19 has demonstrated that technology is a key enabler of business, and that many CIOs have witnessed an increase of the appreciation towards IT. As a result, our last Pulse survey found that CIOs expect an increase in investment in many areas as lots of challenges remain to be addressed beyond enabling business continuity. This is also confirmed in our last CEO survey. Below we look into a few of them.

CEO Survey 2021 – Priorities PwC

CEO Survey 2021 – Evolution of long-term investment priorities PwC

Luxembourg CIO pulse survey 2020 PwC

How is the Cloud assisting the Digital Transformation?

Cloud Computing is the key foundation for a new agile business model. It provides on-demand access to the IT resources underpinning new digital business offerings. Financial institutions can scale their IT infrastructure as needed to support changing business priorities, while reducing risks of wasted resources that inhibited past investments in the digital arena.

Cloud can support financial institutions to experiment and introduce innovative products and services into the market. Indeed, banks can have access to data analytics and AI capacity via readily available cloud infrastructure, without the large upfront investments underpinned by traditional approaches.

There are various use cases that could be applicable to financial institutions when moving to the cloud. One example is around fraud detection. As transactions become digital, the risk of fraudulent payments increases. By leveraging machine learning and the power of cloud, identifying payment fraud on a real-time basis becomes possible. Another example is to leverage the massive processing power of cloud for credit-risk simulation, where a bank could simulate various scenarios in parallel to assess the financial health of its customers. Cloud could help in reducing the processing time at a lower cost. Many other use cases can be applied from Sales and Marketing, Customer Servicing to Modern Workplace, or Human Resources system modernisation, amongst others. In fact, most key software vendors now have a clear cloud strategy as a backbone of their product development. Financial institutions that do not look carefully into it might run the risk of lagging behind very soon.

As transactions become digital, the risk of fraudulent payments increases. By leveraging machine learning and the power of cloud, identifying payment fraud on a real-time basis becomes possible.

Cloud is progressing in the FS sector, including in Luxembourg. Overall, the use of cloud in the FS sector is clearly progressing, although not at the same level than in other sectors. This is explained by the fact that financial institutions operate under strict regulatory requirements and must plan and prepare their cloud transformation more thoroughly.

During the COVID crisis, a lot of attention has been given to collaboration platforms, to make remote work possible and more efficient and keep business activity possible. Financial institutions have learnt from it and are poised to go beyond. Some actors are now redesigning their whole delivery pipeline, moving from an on-premise manual process to a more cloud-based automated CI/CD process, urged by the necessity to integrate more cloud-based solutions and with the objective to accelerate delivery, increase ability, integration and security of their solutions.

Overall, we believe that financial institutions will gradually be moving towards a hybrid cloud approach, made of private and public cloud services. This dual approach also makes exit strategy for critical or important services more realistic.

A combination or emerging technology. The cloud adoption is not merely a possibility to replicate existing on prem practices for less. It is also an enabler and a catalyst for the adoption of other technologies. The first ones are certainly those related to artificial intelligence that have enabled the adoption of mass customisation strategy (e.g. robot advisor) or hyper automation. Low code platforms allowing citizen coders to quickly create robust and scalable business apps will also play a role, as well as blockchains, which is progressively gaining in adoption both in terms of regulations (e.g. ) and of practical use case for intangible assets (e.g. )

Digitising is not an objective per se, it needs to bring value to the user. As our Paul Leinwand and Mahadeva Matt Mani mentioned from PwC Strategy& in their . To win in the post-COVID world, leaders must re-imagine not just how their company works, but also what they do to create value in the digital era. This would include 1) Reimagine its place in the world, instead of focusing on digitising what you already do; 2) Create value through ecosystems, rather than trying to do it all alone; and 3) Re-imagine its organisation to enable a new model of value creation, rather than asking people to work in new ways within the confines of the old organizational model. In order to achieve this, the user experience approach has proved to be invaluable for its ability to federate the different dimensions of the analysis while ensuring to deliver value that matters to the users.

For more information about PwC, click .