While the industry progressively started to understand the importance of strong corporate governance for the long-term profitability of their business, the environmental and social dimensions of ESG have been largely overlooked – compared to real estate or public equity markets.

Given the size of the industry, it plays a vital role in addressing climate change, social inequalities, and other challenges. Its specific business model – with either control or significant influence over portfolio companies – gives it a clear advantage over public equity to drive and implement its sustainability agenda.

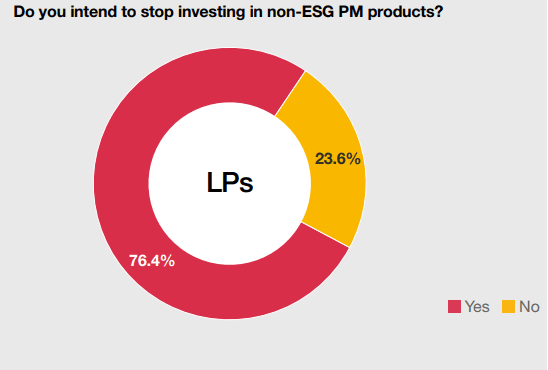

A recent survey from PwC highlights that more than 75% of limited partners will stop investing into non-ESG Funds.

In recent years, the concept of sustainability has evolved from a concern expressed by a limited number of ESG-aware groups into an era defining societal issues that resonates worldwide. Private equity managers did not escape to this global trend, and the largest asset owners— including Pension Funds and institutional investors—are increasingly focused on ESG related issues. A recent survey from PwC highlights that more than 75% of limited partners will stop investing into non-ESG Funds. In addition, their level of understanding of ESG-related issues and their importance in making investment decisions both significantly increase over the past two to three years. They moved what was more of a tick the box exercise in due diligence questionnaires to a thorough and comprehensive assessment of every general partner and every fund in which they invest.

Do you intend to stop investing in non-ESG PM products? (Illustration: PwC Luxembourg)

With ESG moving up the agenda, Private Equity managers have reassessed the importance and the value of ESG to their business on ESG Funds. They understood the urgent need to be proactive by adjusting their strategy and commitments and to embed ESG issues not only in the short term but in their long-term value narrative. They shifted from considering ESG from a pure risk management perspective into a key driver for value creation and a differentiator in a very competitive market with challenging fundraising conditions.

Although Private Equity managers are taking necessary steps to integrate ESG at all levels of their decision-making process from sourcing to exit, several challenges remain. The main ESG-related challenge that Private Equity Managers are facing is the lack of available and reliable data to comply with their reporting requirements. The opaque nature of private investments, with unlisted companies not being required to make the same levels of disclosure as their listed peers continues to be a barrier to smaller Private Equity Managers willing to integrate ESG factors into their decision-making process.

Another challenge is the lack of a standardised framework for ESG reporting. Every Private Equity manager has its own set of ESG KPIs and simultaneously they all receive different ESG data requests from their investors. Industry initiatives emerge to address this challenge such as the ESG Data Convergence Initiative (EDCI) which aims is to enable comparative reporting around a set of ESG metrics.

Although Private Equity managers are taking necessary steps to integrate ESG at all levels of their decision-making process from sourcing to exit, several challenges remain.

These challenges – which are inherent to private equity investments – are exacerbated by regulatory requirements have that not been designed for their specific nature. As an example, all commitments made by Private Equity Managers in their SFDR precontractual documents should be considered as binding and must be met on an ongoing basis. The different stages of private equity investments with fundraising, deal sourcing, investment and exit make it very difficult for Private Equity managers to comply with a minimum proportion of ESG or sustainable investments on an ongoing basis.

As a result – and in an environment where all ESG reporting and claims will be scrutinised by both regulators and investors – Private Equity managers are exposed to greenwashing risk. Greenwashing can be defined as misleading or unsubstantiated claims about the sustainability performance of a fund. While greenwashing can damage the brand reputation or worse, it is key that the Private Equity industry does not shy away at this critical time.

For decades, auditors have played a central role in ensuring accurate financial information. Mandatory audits on financial data are an undisputed given. Like financial data, sustainability claims should be verified by an independent party qualified to assess the data. Greenwashing is a challenge that the auditing industry alone cannot solve, but it is ready to play its part to tackle this challenge alongside other members of the Luxembourg ecosystem.

Author: