For the 2nd consecutive year, Accenture and Bâloise Assurances Luxembourg surveyed more than 1,000 consumers on their current experience of insurance services and their future expectations. Our 2020 Market Pulse Survey (MPS) reveals that to successfully outmaneuver the complexities of changing consumer behaviors, accentuated by the current global pandemic, insurers must repivot towards digital and infuse personalization in their core services.

Will they manage to chart a new course? Voyages can be perilous, and insurers must be able to weather the storms of change and steer around obstacles both on the surface and lurking underneath.

Digital deficit

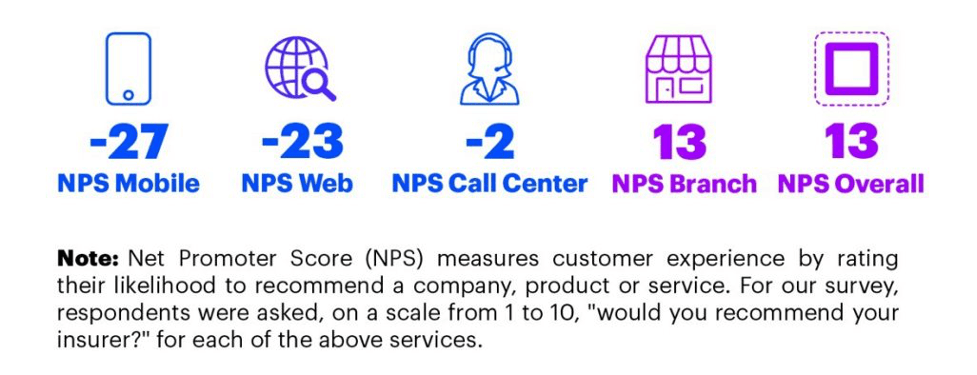

Last year’s survey already highlighted customer preferences for digital touchpoints and their dissatisfaction with available digital channels. The onset of the pandemic, and the constraints on physical interactions, has intensified this and yet customers are still not convinced by the quality of non-human customer services their insurers are offering. This is best illustrated by the 2020 Net Promoter Scores (NPS):

Net Promoter Scores (NPS) Accenture

For insurers to thrive, they must now begin to rapidly improve the ways in which they digitally interact with customers across web and mobile channels.

However, simply digitalizing human touchpoints is not enough. Insurers should holistically review the entire customer value proposition using a digital lens.

Today, 44% of respondents are dissatisfied with becoming customers through digital mediums.

This is a threat to insurer growth because it relates to customer capture at the first step of customer journey.

Changing needs & loyalties

Demographic preferences have a greater impact than ever before. Today, depending on their age group, consumers have a unique set of needs. Accounting for these preferences will allow insurers to more effectively shape age-based customer retention strategies:

Younger customers (18-29 yrs. & 30-49 yrs.) are particularly demanding and seek convenience and an extensive product range. Our survey finds that on average, 35% are willing to leave their current insurer for another insurer offering services they are not provided with.

Older customers (50+ yrs.) seek personalization and support. A lack of these is one of the main reasons given for leaving their current providers: 30% would leave due to insufficient support from advisors and 28% would leave due to lack of tailored advice specific to their personal context.

ONLY 27% of respondents to our 2020 survey state that they would never leave their current provider, while 34% are willing to change insurers if they had to make a fresh start. Loyalty is no longer guaranteed, and customers are more openly considering who their future provider might be.

A question of sink or swim

There can be little doubt that insurers are taking on water. To avoid sinking, they need to plug the holes that represent their weaknesses.

5 out of 7 of the lowest rated customer satisfaction dimensions, aggregated across all customer segments, are associated with digital services and offerings. This is the structural weakness of all Luxembourgish insurers today. While overall customer satisfaction is high and stands at 93%, for satisfaction categories orientated towards digital, the low satisfaction rates paint a worrying picture:

· Digital purchasing: 51%

· Digital product management: 51%

· Digital onboarding: 56%

· Digital claims: 57%

· Innovation / New products and services: 57%

This weakness is accentuated when considering demographic shifts. Younger customers, who represent the long-term future of the market, are more demanding of convenience, speed and efficiency – the hallmarks of ‘digital in the new’ services.

Set sail, buoyed by past success

Insurers must not be discouraged. They already have all the building blocks for success. By using their strengths in the right way, insurers can transition into a future where customers enjoy the convenience of digital services blended with the personalized support associated with human advisors.

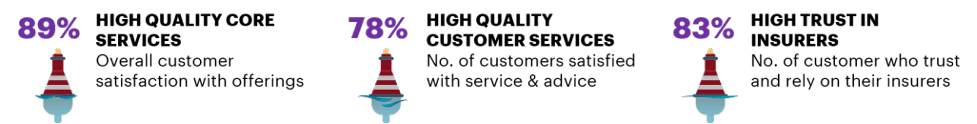

The findings of both our 2019 and 2020 surveys point to the fact that overall, insurance services are still very well perceived in the Luxembourg market.

Based on the findings of the 2020 survey, insurers possess a number of inherent strengths:

Number of inherent strengths Accenture

That insurers are also given an overall NPS of +13, indicates the following; insurers do know how to service the needs of their customers with well-rounded offerings driven by physical interactions. By capitalizing on this ability, insurers can design high-quality digital services that keep pace with the demands of new generations to come.

Take the helm & explore new horizons

Every ship needs a captain. In the post-Covid-19 world, insurers must take the helm and steer towards a future that protects their core services and enables new ones.

Firstly, insurers should start at the very core of their services portfolio by enhancing claims management for home, health & life insurance. In fact, claims management plays a prominent role when analyzing why customers are currently leaving their current providers:

18% leave because their claims are not handled as expected;

14% leave because it takes too long for their claims to be paid out.

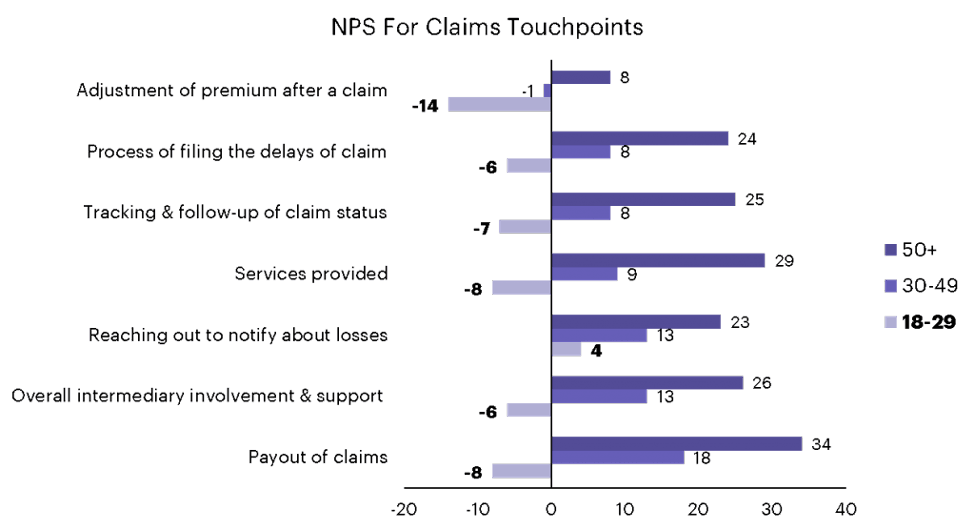

Furthermore, and in the context of the future, insurers must reassess the claims approach for younger customers (i.e. 18-29 yrs.). Their NPS ratings, for 6/7 claims touchpoints, were negative. Transforming perceptions of this strategic customer segment for this crucial service will take precedence and occupy insurers in the short-term.

NPS For Claims Touchpoints Accenture

Secondly, insurers must balance human experiences with efficient digital and on-demand support channels. This is relevant for a key aspect of the claims journey – i.e. filing and following-up claims. Here, respondents highlighted a clear preference:

· 57% - Email

· 46% - Phone call

· 32% - Website / app.

· 14% - Chat with advisor (physical)

· 9% - Video call

This preference for tailored and speedy support reflects a general and historic trend within the market.

For 41% of respondents, speed and efficiency are a main reason to stay with their insurer.

This implies a shift towards on-demand services. While such services are most effective through digital and remote mediums, insurers must make sure they are still anchored to personalization.

Lastly, to truly stand-out in a small market, insurers must capitalize on the first-mover advantage. Therefore, they must proactively captain their ships, and pivot to evolve with speed. They must use the winds of digitalization to sail through the mist. If not, they risk remaining oceans away from their customers.

The global pandemic has magnified the obstacles facing the insurance industry today. These are uncertain times. However, this should not stop insurers from actively navigating around past traditions. Rather than standing still, they must embark on the journey to the New, with confidence and conviction. The digital horizon awaits.

Find out more in the infographic summary

For deeper insights based on our survey, feel free to contact