Beyond the latest Brexit shenanigans and related intrigue, which, as a financial services professional and investor I follow with great interest, I recently came across some ominous figures: currently only 40% of global banks are able to create value, and 35% of them are in troubled waters, with yield curves flattening and global investor confidence weakening. Is that the end of a cycle?

Indeed, this report from McKinsey’s Global Banking Annual Review 20192 – “The last pit stop? Time for bold late-cycle moves” – discusses the potential upcoming challenges for the global banking system, explaining that these could ring the end of the banking industry as we know it.

While each bank’s approach will differ from one to another, I am a firm believer that they need to address their single shared challenge if they want to survive: ensuring they stay relevant and important to their clients.

Private banks and the private banking and wealth management arms of large banking institutions, which traditionally represent the most profitable segment of the banking industry, also have reasons for concern. Another McKinsey report published in September of this year warned of “An inescapable call for action”3 for European private banks as two-thirds of the players have not been able to improve their profitability in the last five years.

As we enter an era of minimal to negative interest rates, with other major macro factors, such as an increasingly uncertain global geopolitical environment, digital disruption and climate change all influencing growth and consequently the banking industry, these reports rightfully call for ‘bold and critical action’ for industry players to find new approaches to lay down future-proof foundations to secure the sector’s continuity and success over time.

While each bank’s approach will differ from one to another, I am a firm believer that they need to address their single shared challenge if they want to survive: ensuring they stay relevant and important to their clients.

A snapshot of current influencers and needs of HNW families

I found 3 major elements influencing the wealth planning and management needs of HNW families.

Today wealth is more globalised with families becoming increasingly more internationally mobile. The latest “Wealth Report” from Knight Frank4 shows that 36% of wealthy clients hold a second passport or nationality, with 48% of them sending their children abroad to university and about a quarter planning to buy another home in a foreign country in the next months. In these circumstances, clients require advice to support them with efficient wealth structuring solutions which can match their internationally mobile lifestyles.

There is greater complexity in modern families and thus it is important for clients who are the current wealth holders to be able to adapt their strategies while controlling their wishes and approach to succession planning.

Family dynamics is the second key influencer. Today’s family model is far less traditional, with fewer first time marriages, an increase in divorces, same sex marriages, and the dispersal of families across the globe. There is greater complexity in modern families and thus it is important for clients who are the current wealth holders to be able to adapt their strategies while controlling their wishes and approach to succession planning.

Last but not least, with 30 trillion USD to be transferred to millennials in the next decade5, there are concerns from current wealth holders on how their heirs will take responsibility for managing their family’s investments or their capacity to be responsible enough to do so. This is an essential challenge for private bankers and wealth managers as research shows6 that they lose up to 50% of their clients’ assets when passed to the next generation.

How to stay relevant in an uncertain world

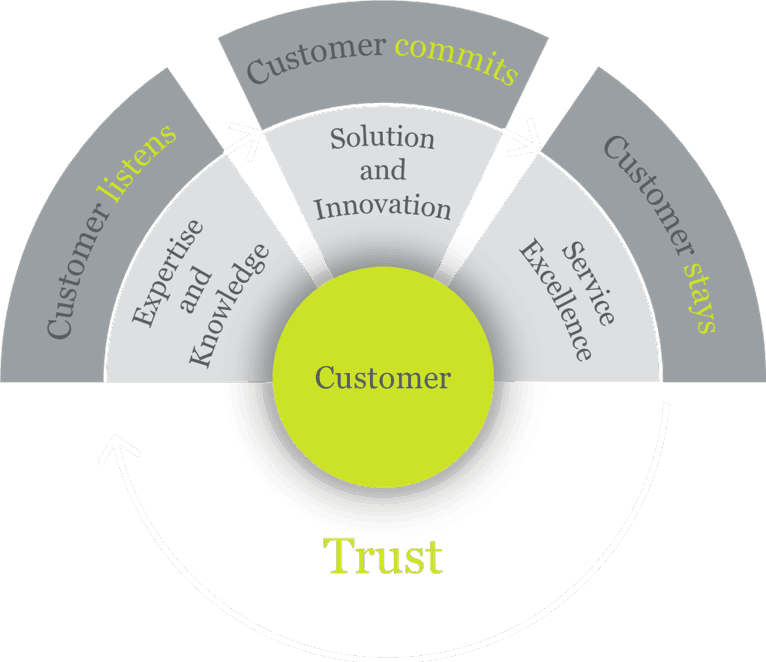

There is no silver bullet or secret recipe which will magically ensure future success for the private banking industry. There is however a simple, yet comprehensive approach that can help these advisers to stay relevant and build further trust with their clients and the future generations within the family of these valued clients. Inspired by the famous KISS principle1, this is how we successfully enhance our relationships with our partners and clients at Lombard International Assurance.

It all starts by having the client’s attention. We believe that in order to achieve this, we demonstrate tangible expertise and knowledge at all times. In our case, elements such as our proven wealth planning in-house expertise across 20+ markets, our leadership role in regulatory change (such as PRIPs, IDD, DAC6, GDPR, etc.), or our sustained long term investment in the local markets where we operate help us provide a visibly distinct and superior value proposition.

Building innovative solutions which forecast future needs is also important to demonstrate commitment to our partners and clients. Beyond the tailor-made nature of our wealth planning solutions, we are always looking for what more we can do for our partners and clients. Some examples of our innovative approach include the private equity and debt distribution programmes we have launched, and additional wealth life cover options across some of our core markets or other multi-custody and multi-asset manager offerings within a same policy. These innovations bring additional added value for clients which in turn increases their loyalty.

Last but not least, it’s making sure that the clients stay by delighting them with excellent service. This covers market dedicated resources, proximity to local staff in core markets, a front-to-end servicing process based on a blended mix of relationship management and our digital platform, Connect.

Customers categories Lombard International

While one could argue that all businesses are different, they are all built on demonstrating customer value and as simple as it might seem, it is to me the essence of the success and something which the private banking industry has built its reputation on; and it’s time to get back to it!

1

2

3

4

5Ernst & Young 2017 Sustainable investing: the millennial investor

6PwC Luxembourg Wealth Management report 2018