In this context, institutions are required to submit hundreds of thousands of data points in different templates and formats to various supervisors (European Authorities, national authorities, or both). It is worth noting that the reporting deadlines and frequencies at which data points must be reported to the relevant supervisory authorities vary greatly across national jurisdictions.

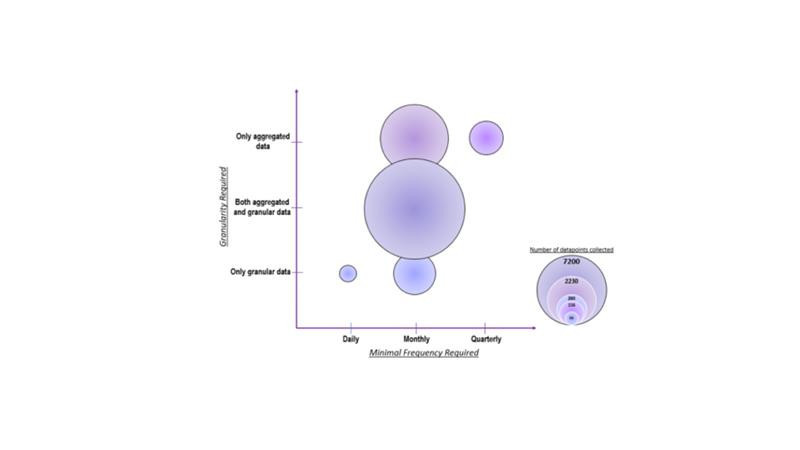

The graph below shows the frequency and granularity of the current data points collected by the European System of Central Banks (ESCB).

Overview of the frequency and granularity of the current data collected by the ESCB Avantage Reply Luxembourg

In addition to the regular data collection by the ESCB, the national Central Banks can request additional ad-hoc data required for other supervisory tasks. According to the ECB the rough estimate of ongoing annual reporting costs to the European financial industry is equal to €4 billion.

Moreover, the data sharing among European Authorities is limited due to, amongst others, the differences in data model, data point definitions and IT related issues. Thus, banks are required to fill in templates in which data points partially overlap. Furthermore, data definitions often differ making it difficult for institutions to harmonies the data collection process. This imposes a significant burden on the day-to-day business of institutions.

A standard data dictionary and a central data collection point as main prerequisites in the proposed reporting system.

In response to these issues and the growing concern within the industry, the ECB recently published their opinion “[1] The ESCB input into the EBA feasibility report under article 43c of the Capital Requirements Regulation (CRR2)” regarding the integrated reporting system for the collection of statistical, resolution and prudential data from banks. In this context, the ECB proposes an integration of common data dictionary, data model and a central data collection point to reduce the reporting burden, to increase data quality and to improve the consistency of submitted reports. The development and implementation of the integrated reporting standards will be supervised by a joint committee.

The implementation of a standard data dictionary represents one of the main pillars of the desired integrated reporting system containing all definitions of the concepts to be reported, transformation rules and the validation rules for the final output. A well-defined standard data dictionary can also provide data for ad-hoc regulatory needs, even though the ad-hoc data collection is not part of the integrated reporting system. The first step in the implementation of such a data dictionary has already been put in place through the creation of the Banks’ Integrated Reporting Dictionary, a collaboration project between authorities and banks aiming to define the transformation rules for data inputs before it is sent to the authorities.

The implementation of a central data collection point is the second pillar of the proposed integrated reporting system. The central data collection aims at changing the way in which data is being transmitted to the authorities. This should lead to a significant reduction in the burden of regulatory reporting for banks and reduce cost by removing the necessity to run complex processes several times. The idea behind the central data collection points is based on 4 principles:

1. Banks to report data only once

2. Facilitation of data sharing between authorities

3. A consistent approach across countries (especially important for large groups)

4. A decentralised approach within a common set-up and governance

The end of the reporting paradigm?

It remains to be seen how much this integrated reporting system will reduce the regulatory reporting burden for financial institutions, but we already have some clues.

In the short-term, we expect banks to face additional challenges. The introduction of this new way of reporting will temporarily increase the reporting burden for banks because the integration of the standard data dictionary and the central data collection point will be performed on top of current business as usual activities. The change in the reporting landscape will impact both business and IT operations. Banks will need to consider several activities such as systems upgrade, testing and data cleaning (errors at a detailed level will be more visible when not aggregated). The regulators and the joint committee must take actions to support banks during this change process. In order to limit the upcoming burden, regulators could look to organise the migration of reporting on a batch basis. Once a batch passes its validation, the underlying reports could then be deactivated.

In the long term, the implementation of the integrated reporting system should reduce the regulatory burden for the financial institutions. Moreover, banks should expect to gain efficiency by optimising their data collection processes, avoiding ad-hoc reporting requests and centralising their reporting capabilities into dedicated “factories”. The resultant time and resources savings could then be allocated to more strategic activities.

The ESCB input into the EBA feasibility report under article 43c of the Capital Requirements Regulation (CRR2), Annex I

The ESCB input into the EBA feasibility report under article 43c of the Capital Requirements Regulation (CRR2), p.6