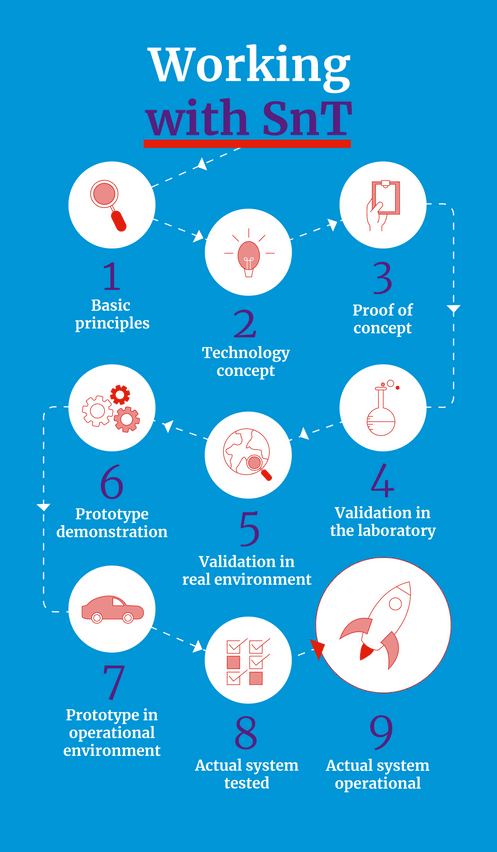

Luxembourg businesses in this position have a valuable potential ally in a centre at the University of Luxembourg. The (SnT) has a mission to transfer technology to public or private actors in the Luxembourg economy. As part of their , SnT currently works with over 50 companies both locally and abroad.

Focus on financial sector

With the economy’s large financial sector, it’s no surprise that SnT is doing a lot of work with Luxembourg’s financial companies, from new FinTech start-ups to established institutions. This sector is facing increased compliance obligations, expansion into new areas like sustainable finance, as well as dealing with customers looking for a more personalised service.

SnT seeks to set up long-term collaborations to help companies achieve innovation that establishes them as a front-runner of their field.

There’s a very strong emphasis on training people in the company, giving them access to the latest technologies and helping them adjust to them.

Jointly set challenges

SnT jointly defines the challenge with the firm. “It is a business challenge for the company, and a scientific or innovation challenge for us,” explained Duprel. Their project is then overseen by a lead researcher and is assisted by a Ph.D. student. SnT has more than 70 doctoral students working directly within its partner companies.

“We offer expertise in artificial intelligence, machine learning, blockchain, distributed ledger and analytics technologies, among others,” he continued.

Automated consistency-checking

One of their current partners is Clearstream, whose digital transformation project involves documenting hundreds of complex specifications, which must be coherent for the new systems to work. SnT has developed an automated tool using artificial intelligence, which lets an employee define and check the specifications. “We estimate that this tool allows the process to go twice as fast, and leads to a higher quality result of the digitalisation project,” explained Duprel.

Another partner is Luxembourg financial regulator, CSSF. Every year, CSSF receives tens of thousands of fund prospectuses that are hand-checked. SnT is developing an automated compliance-checking tool, which partially automates this process using natural language processing. “The tool we’re developing actually understands the regulation that a fund should be tested against, scans the document and checks the different types of information provided,” said Duprel.

Knowing who you’re dealing with

A pride and joy of SnT is an upcoming new spin-off (the centre has five of these so far) called DigitalUs, which helps financial sector actors fulfil the time-consuming background checks in Know Your Client/Anti-Money Laundering obligations. “We developed a very sophisticated web-scraping algorithm where you can collect publicly available information about people who are seeking to use your company’s services in a GDPR-compliant manner.”

Businesses interested in technological innovation need to make it a key component of their firms, Duprel emphasised. “It’s not something that you start today and finish tomorrow,” he said. “It requires a different way of thinking and, most crucially, it requires the right people.” He pointed out that while everyone is facing obstacles, “you will continue to face challenges over the coming years because the speed of change in your sector will not decrease.”

SnT Partnership Programme (Illustration : Maison Moderne)