Threestones Capital needed highly professional, flexible service providers who could be counted on to deliver tailor-made Transfer Agent (TA) and Fund Accounting (FA) support and AIFM services. In May 2020, the company took matters into its own hands and decided to create the TA/FA services it wanted for itself, by itself.

Today, the company has comprehensively re-tooled and developed streamlined in-house management processes that meet the company’s rigorous expectations. In fact, it has been so successful that it is launching the service for external clients! Threestones Capital is now on the verge of officially announcing the offer of its full range of A-Z Third Party Manco services to the fund market. Following the official launch, the commercial offer will consist of accompanying and assisting clients in setting up and managing their funds.

I joined as a financial controller, and after five years, I am now a board member of the General Partner and the AIFM.

Who is Threestones Capital Management?

Threestones Capital is a fast-growing independent investment management group that has been headquartered in Luxembourg for 13 years. The company manages private equity real estate (PERE) regulated investment vehicles under the supervision of the Luxembourg financial authorities (CSSF).

In compliance with European financial regulations, Threestones Capital is an AIFM (Alternative Investment Fund Manager) that acts in accordance with the AIFM Directive. The company understands the needs and expectations of funds in terms of management. It currently has four active funds and has a strong track record, with two exited funds giving an annual internal rate of return (IRR) of 13%.

Threestones Capital’s TSC Fund is mainly invested in the niche senior-healthcare real-estate market in Germany, Spain and Italy. It also manages a strategy in German residential real estate and has even launched a new PE vehicle.

The company’s senior employees have been in the AIF business for over 15 years and have the expertise and knowledge necessary to handle this complex sector. They can also provide tax and legal assistance.

Because we are Central Administrators and TA’s our clients turn to us as their first point of call for clear information. They understand that we are just like them.

How did Threestones Capital manage to take control?

Being a fund manager itself, Threestones Capital knows the business of developing funds from A to Z. When delegated services in the past, it was frequently left disappointed. Service providers were often off-shore and costly. Many also failed to

provide added value and were plagued with high turnover.

It decided to become to be independent of its service and take on their responsibilities for itself. It invested in an experienced cross-market team, industry-standard systems and used effective and reliable communications to manage their image with clients and regulators. The company’s proprietary Fund Admin system is Oracle-based, and it uses Domos for TA work and other industry-standard tools.

The company has capability and confidence. It is committed to a transparent cost structure and invoicing, and there are no surprises with the final bill. Operators in this market typically take 48 hours to respond to client requests. Threestones Capital responds within two hours.

We understand what is important for our clients. We have the expertise, a successfully tested model and will happily engage in solving everyday and long-term Manco problems. Our service excellence depends on it.

What differentiates Threestones Capital?

In short, the team! Threestones Capital has a flexible, well-qualified, committed and diversified team of 20 people. It is gender balanced and multilingual, with native speakers from Spain, Germany, Netherlands, Italy, Sweden, Georgia and Luxembourg! The company has an extremely low turnover and offers career growth. Employees feel highly engaged and valued. Over recent years, Threestones Capital has invested heavily in its Luxembourgish setup as part of its commitment to internalise and future-proof operations. As a result, Threestones Capital clients can expect tailor-made solutions that reflect the frim’s customer understanding and care.

As far as the execution of the investment strategy is concerned, Threestones believes that local market knowledge and execution strength (deal sourcing, and negotiations along with operation management) are critical factors to successful investments.

In evaluating private equity investments, that are attractive to international strategic players, institutions or public markets, Threestones Capital looks for niche asset classes with stable and predictable cash flows, positive supply/demand fundamentals, a favourable demographic profile and assets with the potential to generate capital gains over five to seven years.

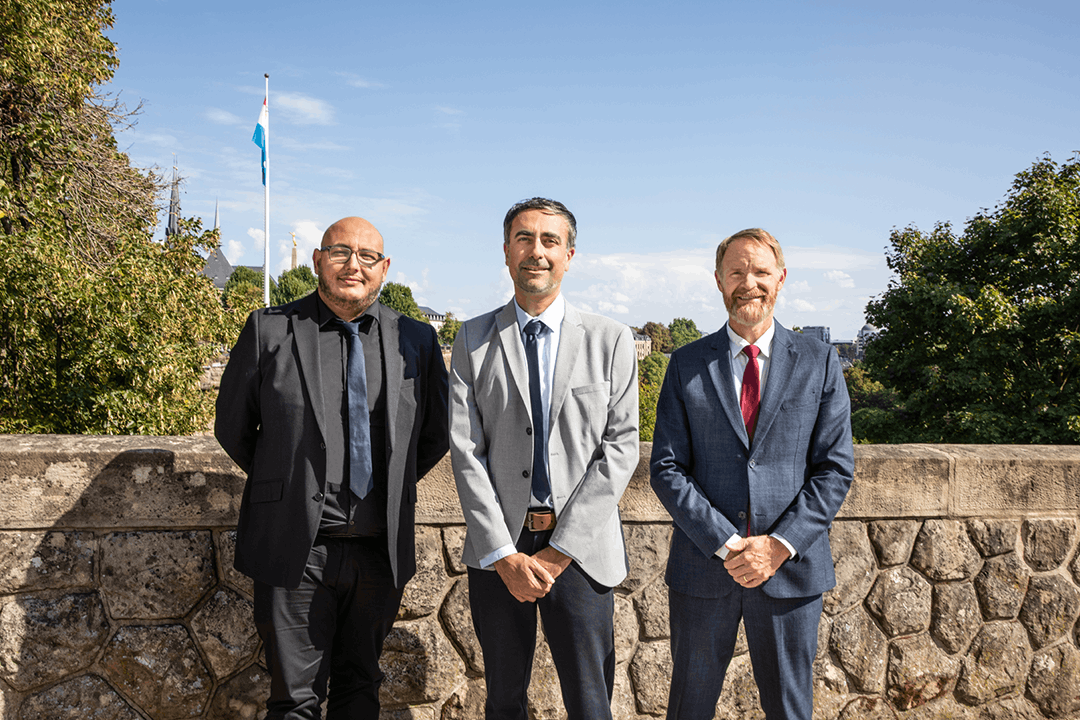

Threestones believes in hands-on direct investment management and precise operations control, and applies a vertically integrated operations management approach. Along with its sister companies, in Berlin and Rome, the firm is managed by three founding partners who are engaged full-time with the business and are aligned with investors’ interests.