Covid-19 & Wealth management: What we ’ve learned so far

As we are learning from the current crisis and from prior systemic shocks, the wealth management industry is a highly interconnected ecosystem. Each ecosystem partner will continue to play a critical role as a systemic stabiliser for investors, their advisors and financial wellness overall. Asset managers, banks, regulators, securities exchanges, technology partners – have all been busy working together, sharing knowledge and best practices, and revisiting common processes. We might want to call this “achieving ecosystem resiliency”, and we think it’s been a valuable lesson for today and post-crisis.

What’s happening now is that wealth managers are further stabilising their businesses by supporting their people and their families, by flexing their digital capabilities and by helping clients make sense of what the Covid-19 crisis might mean for their investments. Also, they are revisiting immediate technology and operational priorities to appropriately support these ongoing business stabilisation efforts as they think about reconfiguration and recovery.

There are additional aspects that need to be considered while thinking through the reconfiguration phase.

Reconfiguration: How to adapt to new ways of working

What we’re hearing from leaders today is an acknowledgement that the current remote working arrangements are likely to be our “new normal” for quite a while. And this acknowledgement is forcing leaders to mothball some initiatives in favor of doubling down on important areas: digital investments to ensure client-facing activities are as productive as possible and ensuring day-to-day operations are moving as smoothly as possible under these challenging circumstances.

We’re hearing a lot of urgency around all things digital. After more than six months of stabilization, the immediate needs of clients have been tackled, but some technical/organizational issues remain because existing processes were not initially built for such a shift in such a short period of time. Leaders are asking questions about client connectivity, paperless signatures, straight through processing, financial planning tools – all aspects of the wealth operating model are being reviewed.

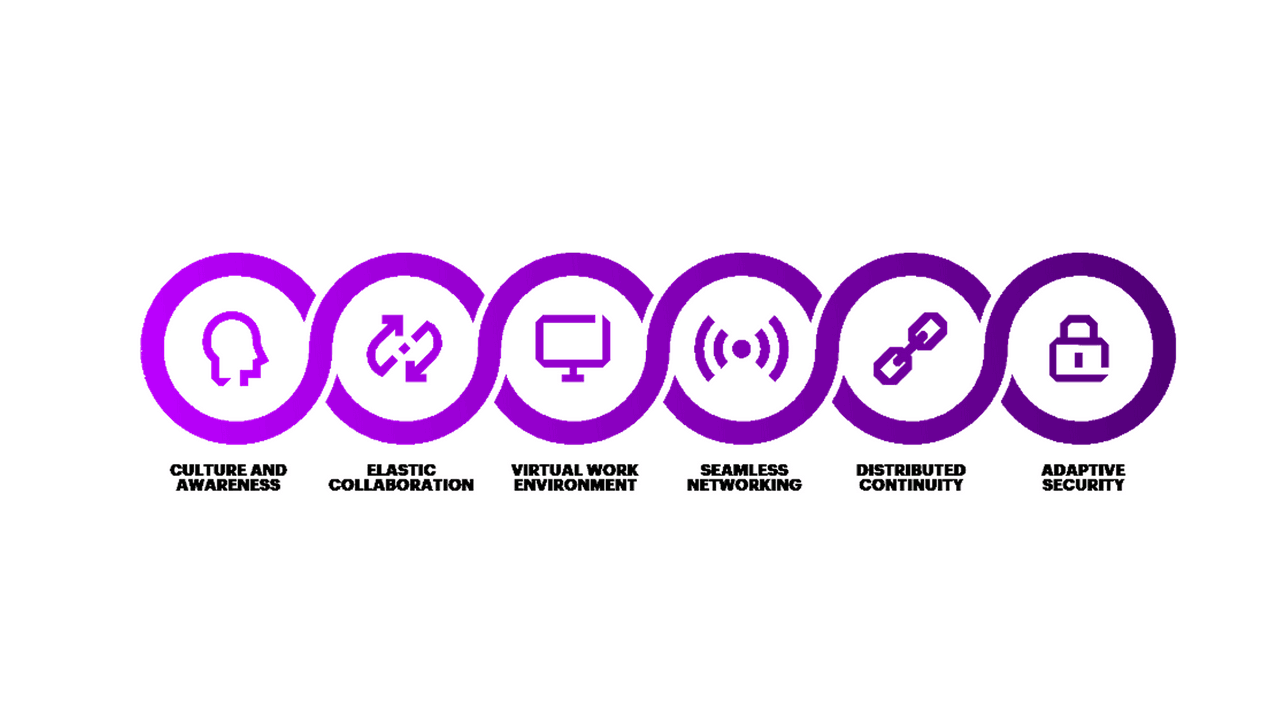

But it is not only about digital and operating models; there are additional aspects that need to be considered while thinking through the reconfiguration phase. Accenture has developed a model with six building blocks that may help guide your thinking.

Six Building Blocks

Six Building Blocks Accenture Luxembourg

Recovery: What does financial wellness mean ?

As the world emerges from this period of disruption, the wealth management industry will have a critical role to play in redefining what true financial wellness is during the recovery. Does it mean a common level of financial preparedness in all citizens so that a household’s finances can withstand a prolonged interruption in income? As a society and as an industry, we need to come to grips with the undeniable linkages between wealth and health. The levels of mental and emotional stress that employees are going through, not to mention the crisis in hospitals and long-term care facilities, point to important changes that likely need to be made at all levels of government, as well as at household level. Wealth managers can play a role engaging households as trusted and empathetic providers of financial advice and goals-based planning.

Advisors must come out of this crisis playing a leadership role in helping individuals make the adjustments necessary to achieve balanced and sustainable financial wellness.

Advisors must come out of this crisis playing a leadership role in helping individuals make the adjustments necessary to achieve balanced and sustainable financial wellness. Beyond a financial plan that allocates savings across a range of investments, advisors should work with their clients to gain meaningful insights into cash flow and credit use in order to help them reset their time horizons. Many of us are applying a lot of our mental energy on just getting through this week or this month. Advisors could leverage behavioral economics to help clients once more think about the longer term and what financial goals they need to work towards. Markets will rebound, inflation and interest rates will come back to normal levels and economies around the world will become healthier.

Now, not everyone who needs this kind of advice and handholding can access a dedicated advisor, so the wealth management industry should revisit and redefine the delivery models that will be economically viable while also meeting the objective of providing financial wellness. That may very well mean an enhanced digital advice capability, including some combination of “digital plus advisor”.

We believe recovering from this crisis is likely to mean firms will accelerate the development of more sophisticated, AI-enabled and analytically driven digital advice capabilities. We call it Digital 3.0 and we think its time has come.

This article was co-written by and .