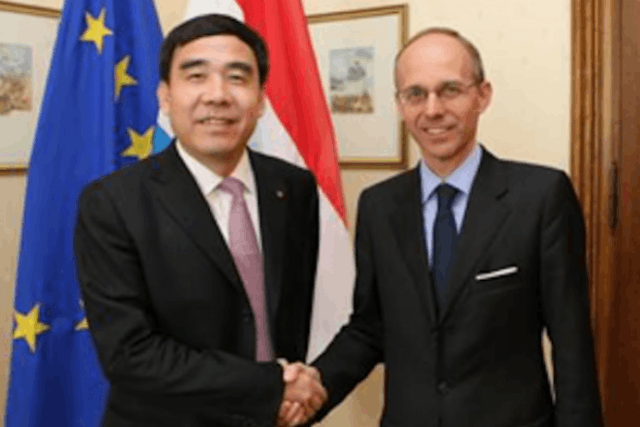

Chairman Tian Guoli of Bank of China Limited led a delegation to visit Luxembourg on 27th and 28th June, and held meetings with senior government officials including Minister Frieden of Luxembourg’s Finance Minister, Governor Reinesch of Central Bank of Luxembourg and Director General of Commission de Surveillance du Secteur Financier (CSSF) regarding cross-border RMB businesses and the Luxembourg Offshore RMB Centre.

During these meetings, Bank of China shared its ambition with officials to become the first Luxembourg RMB clearing bank, providing full support to the development of RMB businesses in Luxembourg. At the same time, the Luxembourg officials complimented Bank of China for its pro-active effort in connection with the setting-up of the Luxembourg Offshore RMB Centre. Similarly, Chairman Tian expressed his deep appreciation to the Luxembourg Government, not only for providing the business-friendly environment, but also for its open, hands-on and pro-active attitude towards the internationalization of RMB.

With a history of a century, Bank of China has an extensive network worldwide, with business covering over 80 countries and regions across five continents. The Bank plays an important role in global RMB clearing business and has been the designated RMB Clearing Bank in Hong Kong, Macau, Taiwan, Malaysia, etc. It currently serves over 130,000 private customers, 4,000 corporate customers and over 900 banks, who have set up RMB accounts at the Bank.

Being the first Chinese overseas financial institution established after the founding of New China, Bank of China Limited, Luxembourg Branch has been active in Luxembourg since 1979. It has made good use of the unique advantages of Luxembourg’s leading position as an international financial centre to develop extensive banking businesses across the borders. Bank of China, Luxembourg today has operations not only in Luxembourg but also in Belgium, the Netherlands, Poland, Sweden and Portugal. At the end of May, the Bank of China, Luxembourg has reached 8.9 billion of RMB deposit, 13 billion of RMB loan, and 38.3 billion of cross-border RMB clearing amount.