Set-up & structure

Double Luxco structures, which involve two Luxembourg companies, have been around for over a decade. They were a response to the risks to lenders posed by French insolvency laws in French Leveraged Buyout (LBO) transactions.

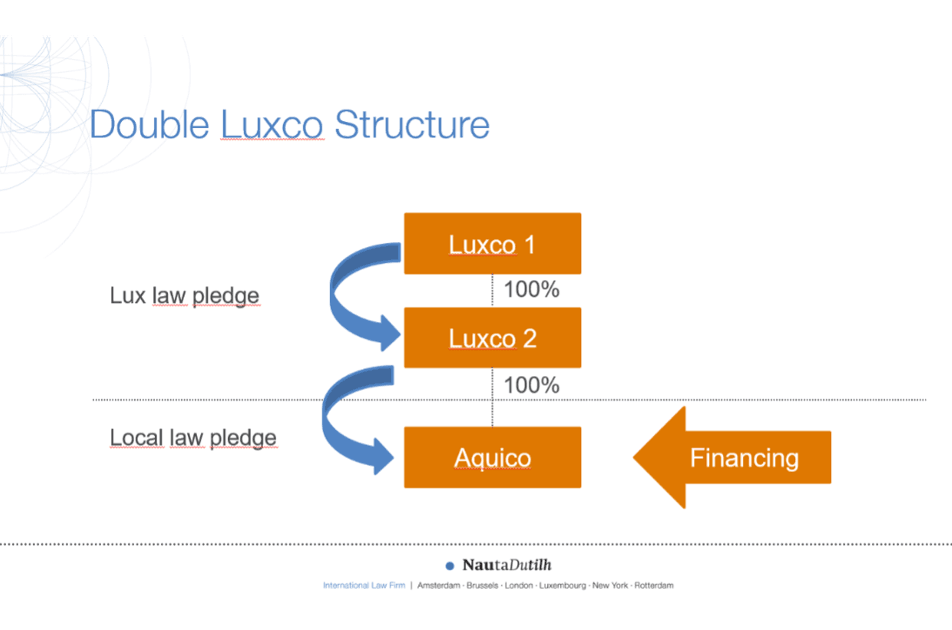

Today, they are still standard for many LBO transactions, notably for transactions involving Spain, France and Portugal. The set-up usually involves a local acquisition vehicle (Aquico) that is held by a Luxco (Luxco 2), which is itself held by another Luxco (Luxco 1):

Double Luxco Structure NautaDutilh

In the above set-up, Luxco 1 grants a pledge over the shares it holds in Luxco 2, which will contain certain features that are specific to Double Luxco set-ups, in favour of the lenders. Luxco 2 grants a (local law-governed) pledge over the shares in Aquico.

Advantages

The structure provides increased protection to lenders and easier execution of security interests at the level of the Double Luxco, which are governed by the Luxembourg law of 5 August 2005 on financial collateral arrangements, as amended (the "Collateral Law"). The flexibility and effectiveness of the Collateral Law allows lenders to maintain influence over the structure (and the management of the Double Luxco) without necessarily enforcing the pledge, while the execution of the pledge itself is a straightforward process that efficiently protects lenders' interests. The share pledge agreement over Luxco 2 is thus the key element of the Double Luxco structure.

Features & purposes

Specific features of the share pledge agreement in the Double Luxco context include the possibility for lenders to exercise the voting rights attached to the pledged shares upon the occurrence of specific trigger events, without necessarily enforcing the pledge itself. This includes for instance voting on the removal and appointment of the management of Luxco 2.

One of the purposes of the Double Luxco structure is to prevent parties from shifting the centre of main interests (COMI) of Luxco 2 outside Luxembourg and initiating insolvency or safeguarding proceedings in another jurisdiction, which would prevent lenders from enforcing their security interests. The shares of Luxco 2 are often bearer shares that are deposited with a depository in Luxembourg in order to ensure that these assets remain located in Luxembourg and, therefore, that the security interest over these shares is recognised under the rules of the European Insolvency Regulation. The enforcement of a Luxembourg share pledge agreement in accordance with the Collateral Law can be a very efficient and straightforward process.

Contrary to many other European jurisdictions, the Collateral Law does not require the payment obligations secured by the pledge to be due and payable in order to enforce the pledge. If agreed between the parties, other trigger events (such as non-compliance with financial covenants or the decision to shift the company's COMI outside Luxembourg) allow lenders to enforce the pledge and take control of Luxco 2 to safeguard their interests.

Double Luxco structures have proven their effectiveness over the last decade and remain an important tool for structuring LBO transactions in Europe, with the Collateral Law ensuring lender protection in times of financial restructurings – as the Double Luxco will continue to do.

If you have any questions about the Double Luxco, please reach out to NautaDutilh's expert .