Background

The financial crisis has revealed major governance weaknesses, particularly for the financial industry. Board members were singled out for failing to fulfil, or perhaps understand, their collective role as safeguards against excessive risk taking and consequently to ensure the long-term viability of their company. In the wake of the 2008 crisis, all market participants should be aware that a board of directors is not simply an institution under company law; it also has an essential role to play.

Hence, the effective role of the board within a company has been a major concern for policymakers and regulators who are willing to change the industry and to show they have learnt from the past. Regulations, laws, codes of conduct or on-site visits by regulatory authorities have significantly increased in recent decades, aiming not to only further specify the responsibilities of the board members and to help them achieve their objectives but also to oversee them. Currently, one of the practices most solicited by regulators and institutional investors to ensure the effectiveness of a board is the board assessment.

Board assessments shall be conducted on a regular basis.

A board assessment is not only considered an essential tool by which the board evaluates its own performance as a whole, but also the performance of each director and board committees. This exercise is recognised as helping increasing boards’ effectiveness, maximizing strengths, tackling weaknesses, improving corporate relationships, and triggering change, when appropriate. Routine assessments allow directors to receive feedback on what they have accomplished and what could be improved, and through which they are able to refocus on the company’s objectives and their accountability towards their peers and the company’s stakeholders.

Board assessment around the world

According to a recent report published by the OECD on board evaluation, board assessment is progressively becoming a common practice worldwide, despite differences in the approaches adopted by various countries.

Several countries such as France, Luxembourg, the Netherlands, Italy, and the UK have introduced provisions relating to board assessments in their respective corporate governance codes, which have significantly increased the number of boards engaging in the formal board evaluation processes. Nevertheless, these codes generally provide recommendations on the principle of “comply or explain”, thus allowing directors disregard these recommendations if there is a valid justification. These provisions are often very detailed and provide enough guidance to encourage frequent and significant assessments so that the assessments can be created without any unnecessary complications. In Luxembourg for example, the ILA and ALFI have published guidelines to assist directors in their efforts to produce a more comprehensive and clear assessment of board members. Complementary to this, the ILA has published a form containing 120 multiple-choice questions upon which directors can base their assessment. Recent statistics show that a considerable number of boards of Luxembourg investment vehicles (i.e. UCITS and AIF) as well as boards of Luxembourg management companies and AIFMs assessed their boards’ performance in 20181.

Board assessments undertaken by an external party can provide a more impartial evaluation and can encourage directors to speak more freely.

Other countries have taken a further step by implementing legal obligations. In the United States, board assessment is mandatory for NYSE listed companies.

How to carry out a board assessment

Board assessments can be carried out through several methods depending on the needs of the board as long as the exercise is not limited to a “tick the box” exercise and adds value for the company. The board can perform this exercise through questionnaires or surveys, allowing participants to remain anonymous, or through facilitated discussions or individual interviews encouraging directors to argue their points of view.

Regarding its content, the evaluation of the board should not be limited to checking whether the directors have fulfilled their objectives but should also test whether the board’s composition, dynamics, and structure are effective for the company. These criteria must be tailored to the company according to its needs.

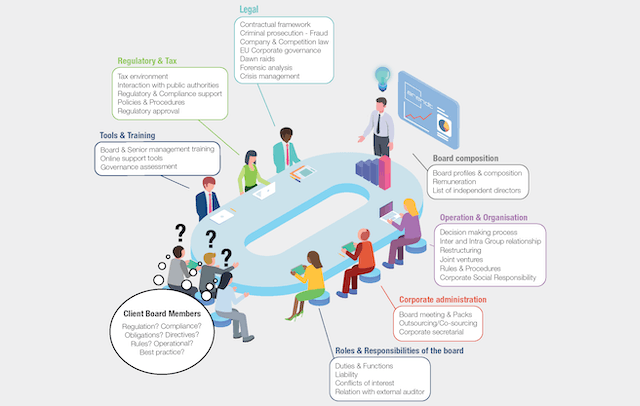

For example, the following themes can be covered, including both qualitative and quantitative aspects:

• Board composition: Do board members have sufficient knowledge and experience appropriate to their roles?

• Board practices: Are members provided with enough information to understand the company’s issues? Are materials communicated sufficiently in advance to allow for informed decision-making?

• Board culture: Does the company encourage debate and exchange of information?

• Board’s objective: Is there a common understanding of the board’s objectives?

Board assessments shall be conducted on a regular basis. As far as the frequency of assessment is concerned, it is specific to the company and its sector of activity and may also depend on important events within the company such as a change in the composition of the board or re-shaping of the business. An independent review is generally recommended at least every two to three years.

Finally, some companies choose to perform the assessment internally by assigning responsibility, for example, to the lead director or to board committees with the support of management. Other companies may use a third party facilitator, such as external advisors, to handle the process. Board assessments undertaken by an external party can provide a more impartial evaluation and can encourage directors to speak more freely.

These external facilitators are, for instance, developing software solutions that can then be adapted to the specific needs of the company.

Whether the evaluation is conducted internally or externally, the consolidation of results should then make it possible to highlight the areas of improvement and define a remediation plan, when necessary.

As a result, performing periodic board assessments allows the board, both as a whole and at the level of each individual director, to improve and fully fulfil the role assigned to them. Nevertheless, the effectiveness of the exercise relies heavily on the contribution of directors, i.e. their availability, responsiveness, and honesty.

More info

Contact us:

Auteurs: Dr. Michael Daemgen, Partner, Arendt Regulatory & Consulting Tania Favero, Advisor, Arendt Regulatory & Consulting

1PwC and ILA, Luxembourg Fund Governance Survey 2018, January 2019,