Whilst the second phase of ATAD2 regarding the reverse hybrid mismatches will just begin to be applied from 1 January 2022 in Luxembourg, the EU Commission launched a public consultation on the use of shelf companies, which should lead to a legislative proposal by the end of this year (ATAD3). In addition, although the interpretation of certain provisions regarding DAC6 remains challenging, on 22 March 2021, the EU Council adopted new provisions extending the EU’s tax transparency rules to digital platforms regarding revenues generated by their sellers (DAC7).

The articulation of these new concepts, reflecting a new mindset in international taxation, with the tax rules currently applicable and dating back (for some of them) to the 60s, does not go without raising some issues. Besides dealing with this increasing complexity and a relative legal uncertainty, taxpayers have to regularly monitor, anticipate changes and adapt, as the case may be, their structure to the new tax framework which has been emerging since a few years under the influence of the OECD. The timeframe left for taxpayers and their advisors to digest and proceed to the necessary adaptations has steadily become tighter.

Unfortunately for taxpayers, the EU Commission does not intend to curb its ambitious initiatives for building a new framework for business taxation in the UE. In addition to ATAD3, it is envisaging to table, by 2022, several legislative proposals regarding the publication of effective tax rates paid by companies and the creating of a Debt Equity Bias Reduction Allowance. Furthermore, in 2023 the EU Commission will propose a new framework for income taxation for businesses in Europe (BEFIT) which will replace the pending proposals for a Common Consolidated Corporate Tax Base (CCCTB). Moreover, the OECD, mandated by the G20, is also paving the way for incoming legislative proposals of the EU Commission. The OECD is currently working on a “global consensus-based solution” based on two pillars to reform the international corporate tax framework. Pillar 1 focusses on the partial reallocation of taxing rights whereas Pillar 2 aims at introducing a minimum effective taxation for MNEs’ profits. In order to ensure the consistent implementation of these rules in all EU Member States, the EU Commission will propose directives. Finally, regarding DAC, the EU Commission is already working on amending the directive to include the exchange of tax-relevant data for new, alternative means of payment and investment, such as crypto assets as money.

Given the number of proposals in the pipeline, it is likely that the terms “ATAD” and “DAC” will continue to echo for a certain period yet and we may anticipate the emergence of new acronyms, synonymous with changes within the current tax framework. While a new tax era is beginning, the coexistence of an old local tax framework with new rules designed for the 21st century will increase the complexity of tax rules which interpretations should become more and more challenging.

Let us hope that the countries will have enough time to properly implement these new incoming rules and that their respective taxpayers will be able to adapt to this new fast-paced tax environment.

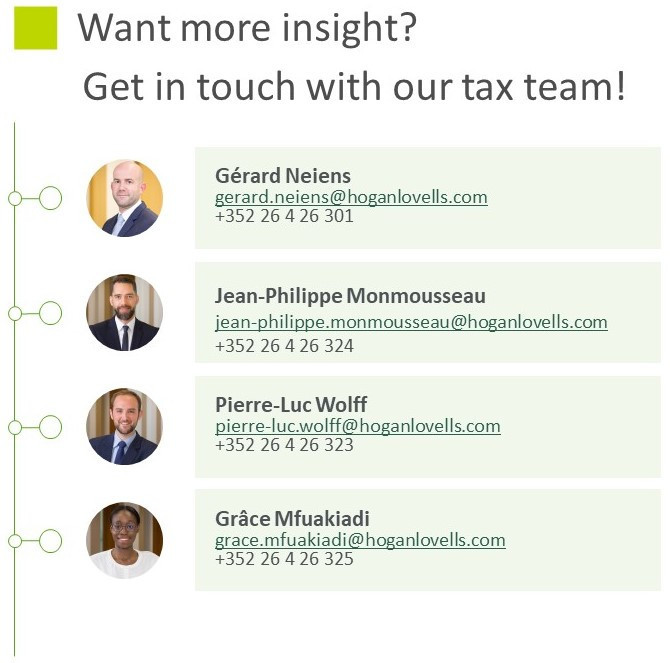

Let’s connect on !

Contacts © Hogan Lovells