Europe’s investment fund distribution actors and the wider fund industry have been subject to many and various calls to change over the past few years.

Fees must come down, say investors. Fees are unclear and not at all transparent say regulators. Operational efficiency, from front office to back office, needs to be vastly improved say both new and established actors. We want to see more investor protection and better compliance say lawmakers. And finally, why can’t we compare, buy and sell investment funds more easily, ask the new generation of investors.

Transition for fund distribution in this context means embracing digital transformation and harnessing technology, as other sectors have already done to their great benefit.

Creating a digital fund distribution ecosystem

The goal now is to make the distribution chain more efficient so that is can deal with these many challenges and importantly to be productive and innovative in the new environment.

Any action, however, must respond intelligently to diverse and seemingly contradictory demands.

The amount of regulatory and tax reporting that fund actors are obliged to transmit to authorities has increased greatly. Digital points of sales are growing and will become ubiquitous. The complexity of the distribution chain remains a stumbling block for many fund companies and overcoming this is fundamental if the industry is to move forward.

For all fund actors as a group, the question is how can this be done in a manner that will help benefit the entire fund industry, including investors.

At the heart of this is the basic question, for individual actors in the fund chain, of how decreasing margins can be addressed while operations are modernised in such a way that value creation is ensured.

For all fund actors as a group, the question is how can this be done in a manner that will help benefit the entire fund industry, including investors.

A digital distribution chain brings fund buyers and fund producers closer, enabling better understanding and insight for fund producers and distributors while significantly improving the buyer experience.

Data exchange drives business

The digital transformation of the investment fund industry means paying more attention to data and information flows than most fund companies are accustomed to at present.

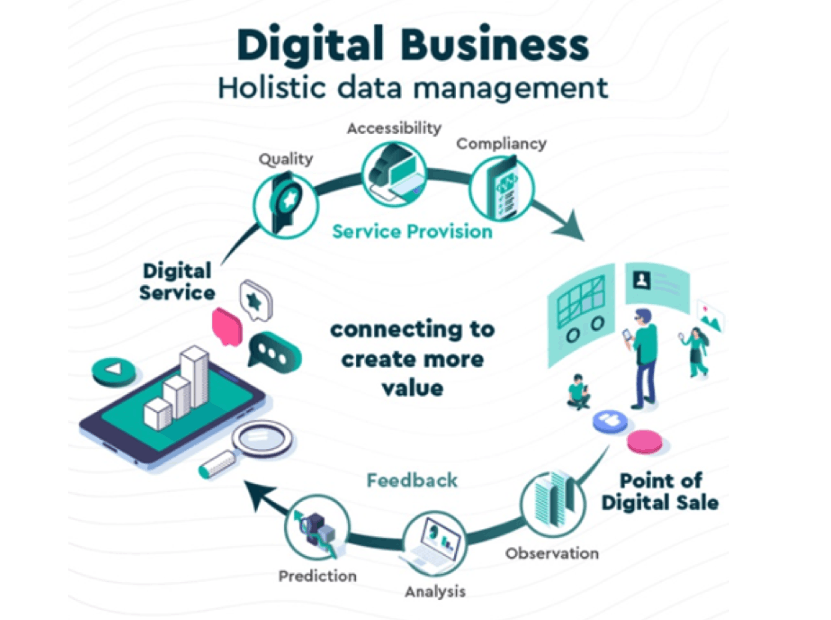

To realise its full potential, fund actors need to take a different view of data and how it can be used. Holistic data management is of immense help here. At its simplest, it is an iterative process that runs in real time and contains delivery and feedback elements.

In this way a digital service provider can gain ongoing insights into the market and consumer behaviour. For the fund industry, these could be as simple as helping companies understand what type of investor buys what product, or it could be as advanced as the product structuring level.

Moreover, a holistic data management model is not just for fund producer and fund buyer relationships. It covers all interactions that involve data and information exchange, for example exchanges with regulators, transfer agents, fund administrators and indeed all actors in the distribution chain.

The possibilities for enriched data feedback and added-value services are therefore almost limitless in this respect.

Digital Business – Holistic data management. Credit: Fundsquare

Data quality is key

The delivery, or service provision, element is split into three distinct phases.

The first is data quality and this is the most important for the fund industry. Today, fund companies devote much time and resources to finding, flagging and correcting erroneous, incomplete and out of date data and information, often manually.

Big data analytics and machine learning can automate this and analyse, cleanse and prepare data. As the crucial first step in holistic data management, ensuring data quality is not an administrative IT-led task but aims to create efficiencies and opportunities further in the process.

The following two phases in the delivery element are accessibility, meaning improving access to the fund industry’s disparate data sources, and compliancy, which ensures that actors have the right information at the right time.

With its complex interactions between multiple parties, the fund industry is in urgent need of solutions that will respond to the many challenges that it is facing.

The feedback element focuses on enriching data already delivered and comprises observation, analysis and prediction phases.

With its complex interactions between multiple parties, the fund industry is in urgent need of solutions that will respond to the many challenges that it is facing.

However, because of the number of actors involved in even the simplest transaction, it is doubtful whether one or a handful of fund companies implementing such processes would be completely successful.

To realise the full potential of holistic data management, a mutualised approach through a central infrastructure would be the most effective solution.

In this way, fund companies can work together to find and use the services that have the most added value for their particular situation and business needs.