What and Why?

If you are a savvy financial consumer or read the financial contract for your student loan or a mortgage, you are likely to see LIBOR mentioned at least once. This is because this rate is the benchmark rate at which major global banks lend money to one another at different maturities (i.e., from overnight to 12 months) and in different currencies (i.e., USD, GBP, EUR, CHF and JPY). This results in 35 different rates (one for each currency and tenor combination) which are widely used by banks as their base cost of funding. Initially developed in 1986 by the British Banker’s Association (BBA), LIBOR was designed to provide a uniform measure of interest rates for financial institutions across the world.

However, regulatory changes after the 2008 financial crisis highlighted the need for a new and better way to represent the cost of funding in relevant currencies. In addition, a number of high profile scandals centred on the ability of major banks to manipulate the rate for their gain further eroded the industry’s trust. As a result, several Alternative Reference Rates (ARRs) were established as replacements for LIBOR (see Table 1).

Table 1. Alternative Reference Rates (ARRs), per currency

Alternative Reference Rates (ARRs), per currency. (Credit: Avantage Reply Luxembourg)

What are the potential impacts of this transition?

The LIBOR transition is a significant event causing a wide range of communication, legal, operational and technological challenges for banks and other financial institutions.

Firstly, business and front office employees will need to develop and plan their client outreach, communication and education. In its consultation on the potential for an increase in conduct risk during LIBOR transition, the Financial Conduct Authority (FCA) emphasised that financial institutions should communicate to their clients in a timely manner and in a way that is clear, fair and not misleading to allow customers to make informed decisions. To achieve this, banks need to develop and implement a communication strategy with the objective to engage proactively with clients to increase the level of information exchange.

Legal challenges comprise of the identification and potential modification of all contracts that reference LIBOR. For the contracts currently referencing LIBOR, banks need to understand the financial, customer and legal impacts of LIBOR cessation. An assessment regarding the availability and robustness of the “fallback language” and the potential remediation considerations also need to be assessed. Banks must keep in mind that negotiations with contract partners might turn out to be a challenging and drawn-out process. Thus, they need to plan the contract remediation well in advance of LIBOR being discontinued.

With regards to operational and technological readiness, this is another hurdle that banks will need to clear in their efforts to become LIBOR free by the end of 2021. Financial institutions should identify all impacted processes, controls, and internal and external IT dependencies to be able to develop a remediation strategy, including new development and sufficient testing required. More specifically, the impacts on Asset and Liability Management (ALM), risk management, valuation methodologies and hedging programmes, not to mention potential impacts on fair value-adjustments, are just some of the areas to be considered. To tackle these, banks need to identify, monitor and control financial and non-financial impacts and establish processes and oversight routines during the transition away from LIBOR to the Alternative Reference Rates.

What should banks and asset managers do now?

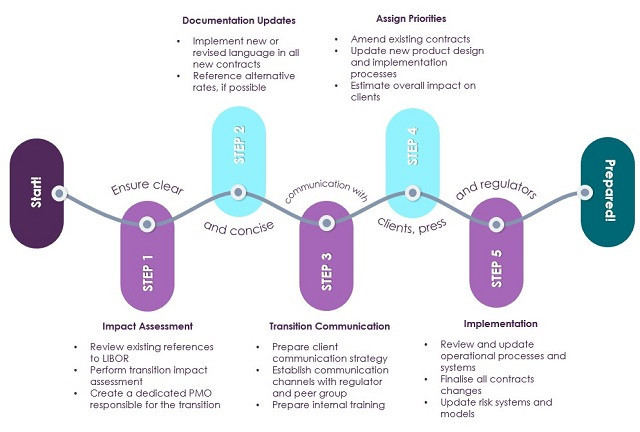

It is expected that the UK financial regulator (i.e., FCA), will no longer require panel banks to submit and publish LIBOR rates after the end of 2021. Thus, banks and asset managers should be prepared beforehand. Here are five high-level steps to consider as part of the transition.

Table 2. How to prepare for the LIBOR transition?

How to prepare for the LIBOR transition? (Credit: Avantage Reply Luxembourg)

This transition is not as easy as “flipping a switch” in the system. To achieve a smooth and functional transition, banks need to spend time planning, assessing and quantifying the impact. They will need to staff and efficiently allocate scarce internal resources. In addition, the time pressure and limited staff availability could cause the need to allocate budgets for external resources or increase hiring. Finally, banks need to make sure an accountable senior executive supports the transition and oversees the delivery, provides the coordination and highlights the importance of the LIBOR replacement initiative. All these aspects have one thing in common – cost. It will remain to be seen how the banks will manage this cost considering already mounting pressure from existing regulations as well as the anticlimactic impacts from the COVID-19 pandemic.

More information about Avantage Reply Luxembourg